HP 2014 Annual Report Download - page 111

Download and view the complete annual report

Please find page 111 of the 2014 HP annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

HEWLETT-PACKARD COMPANY AND SUBSIDIARIES

Notes to Consolidated Financial Statements (Continued)

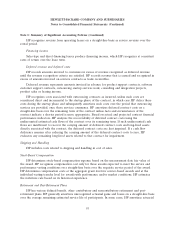

Note 2: Segment Information (Continued)

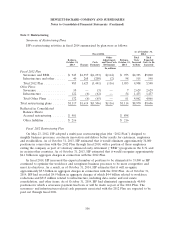

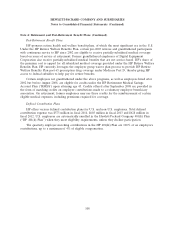

Segment Operating Results

Printing and

Personal Systems

Personal Enterprise Enterprise HP Financial Corporate

Systems Printing Group Services Software Services Investments Total

In millions

2014

Net revenue ..................... $33,304 $22,719 $26,809 $21,297 $3,607 $3,416 $ 302 $111,454

Intersegment net revenue and other ........ 999 260 1,005 1,101 326 82 — 3,773

Total segment net revenue ........... $34,303 $22,979 $27,814 $22,398 $3,933 $3,498 $ 302 $115,227

Earnings (loss) from operations ........ $1,270 $ 4,185 $ 4,008 $ 803 $ 872 $ 389 $(199) $ 11,328

2013

Net revenue ..................... $31,232 $23,685 $27,045 $23,041 $3,701 $3,570 $ 24 $112,298

Intersegment net revenue and other ........ 947 211 1,036 1,020 320 59 — 3,593

Total segment net revenue ........... $32,179 $23,896 $28,081 $24,061 $4,021 $3,629 $ 24 $115,891

Earnings (loss) from operations ........ $ 980 $3,933 $ 4,259 $ 679 $ 868 $ 399 $(316) $ 10,802

2012

Net revenue ..................... $34,892 $24,317 $28,349 $25,090 $3,868 $3,784 $ 57 $120,357

Intersegment net revenue and other ........ 951 221 1,294 903 303 35 1 3,708

Total segment net revenue ........... $35,843 $24,538 $29,643 $25,993 $4,171 $3,819 $ 58 $124,065

Earnings (loss) from operations ........ $1,724 $ 3,612 $ 5,123 $ 1,045 $ 836 $ 388 $(233) $ 12,495

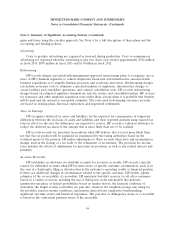

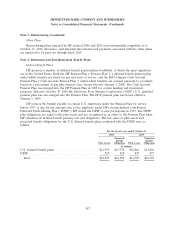

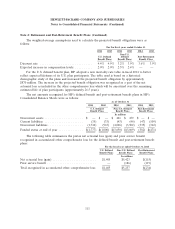

The reconciliation of segment operating results to HP consolidated results was as follows:

For the fiscal years ended October 31

2014 2013 2012

In millions

Net Revenue:

Total segments ........................................ $115,227 $115,891 $124,065

Elimination of intersegment net revenue and other .............. (3,773) (3,593) (3,708)

Total HP consolidated net revenue ........................ $111,454 $112,298 $120,357

Earnings before taxes:

Total segment earnings from operations ...................... $ 11,328 $ 10,802 $ 12,495

Corporate and unallocated costs and eliminations ............... (953) (786) (787)

Stock-based compensation expense .......................... (560) (500) (635)

Amortization of intangible assets ........................... (1,000) (1,373) (1,784)

Impairment of goodwill and intangible assets .................. — — (18,035)

Restructuring charges ................................... (1,619) (990) (2,266)

Acquisition-related charges ............................... (11) (22) (45)

Interest and other, net ................................... (628) (621) (876)

Total HP consolidated earnings (loss) before taxes ............. $ 6,557 $ 6,510 $ (11,933)

103