HP 2014 Annual Report Download - page 101

Download and view the complete annual report

Please find page 101 of the 2014 HP annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.HEWLETT-PACKARD COMPANY AND SUBSIDIARIES

Notes to Consolidated Financial Statements (Continued)

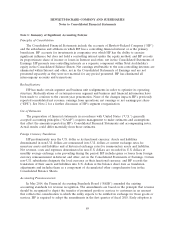

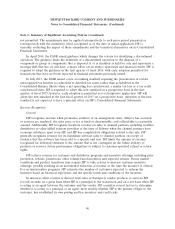

Note 1: Summary of Significant Accounting Policies (Continued)

HP recognizes revenue from operating leases on a straight-line basis as service revenue over the

rental period.

Financing income

Sales-type and direct-financing leases produce financing income, which HP recognizes at consistent

rates of return over the lease term.

Deferred revenue and deferred costs

HP records amounts invoiced to customers in excess of revenue recognized as deferred revenue

until the revenue recognition criteria are satisfied. HP records revenue that is earned and recognized in

excess of amounts invoiced on services contracts as trade receivables.

Deferred revenue represents amounts invoiced in advance for product support contracts, software

customer support contracts, outsourcing startup services work, consulting and integration projects,

product sales or leasing income.

HP recognizes costs associated with outsourcing contracts as incurred, unless such costs are

considered direct and incremental to the startup phase of the contract, in which case HP defers these

costs during the startup phase and subsequently amortizes such costs over the period that outsourcing

services are provided, once those services commence. HP amortizes deferred contract costs on a

straight-line basis over the remaining term of the contract unless facts and circumstances of the

contract indicate a shorter period is more appropriate. Based on actual and projected contract financial

performance indicators, HP analyzes the recoverability of deferred contract costs using the

undiscounted estimated cash flows of the contract over its remaining term. If such undiscounted cash

flows are insufficient to recover the carrying amount of deferred contract costs and long-lived assets

directly associated with the contract, the deferred contract costs are first impaired. If a cash flow

deficiency remains after reducing the carrying amount of the deferred contract costs to zero, HP

evaluates any remaining long-lived assets related to that contract for impairment.

Shipping and Handling

HP includes costs related to shipping and handling in cost of sales.

Stock-Based Compensation

HP determines stock-based compensation expense based on the measurement date fair value of

the award. HP recognizes compensation cost only for those awards expected to meet the service and

performance vesting conditions on a straight-line basis over the requisite service period of the award.

HP determines compensation costs at the aggregate grant level for service-based awards and at the

individual vesting tranche level for awards with performance and/or market conditions. HP estimates

the forfeiture rate based on its historical experience.

Retirement and Post-Retirement Plans

HP has various defined benefit, other contributory and noncontributory retirement and post-

retirement plans. HP generally amortizes unrecognized actuarial gains and losses on a straight-line basis

over the average remaining estimated service life of participants. In some cases, HP amortizes actuarial

93