HP 2014 Annual Report Download - page 146

Download and view the complete annual report

Please find page 146 of the 2014 HP annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

HEWLETT-PACKARD COMPANY AND SUBSIDIARIES

Notes to Consolidated Financial Statements (Continued)

Note 9: Acquisitions, Goodwill and Intangible Assets (Continued)

Intangible Assets

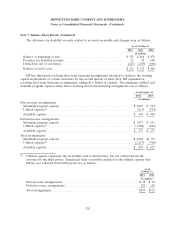

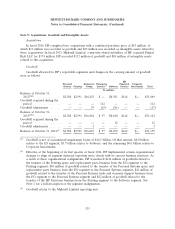

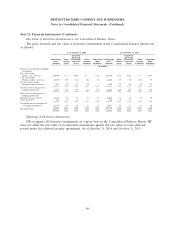

HP’s intangible assets are composed of:

As of October 31, 2014 As of October 31, 2013

Accumulated Accumulated

Accumulated Impairment Accumulated Impairment

Gross Amortization Loss Net Gross Amortization Loss Net

In millions

Customer contracts,

customer lists and

distribution

agreements ........ $ 5,289 $(3,228) $ (856) $1,205 $ 5,321 $(2,709) $ (856) $1,756

Developed and core

technology and

patents........... 4,266 (1,301) (2,138) 827 5,331 (1,966) (2,138) 1,227

Trade name and trade

marks ............ 1,693 (261) (1,336) 96 1,730 (211) (1,336) 183

In-process research and

development ....... — — — — 3 — — 3

Total intangible assets . . $11,248 $(4,790) $(4,330) $2,128 $12,385 $(4,886) $(4,330) $3,169

For fiscal 2014, $855 million of intangible assets became fully amortized and have been eliminated

from gross intangible assets and accumulated amortization. HP also eliminated gross intangible assets

and accumulated amortization related to the sale of a portfolio of intellectual property (‘‘IP’’) in the

first quarter of fiscal 2014.

For fiscal 2013, the majority of the decrease in gross intangible assets was related to $1.7 billion of

fully amortized intangible assets that were eliminated from both the gross and accumulated amounts.

In fiscal 2012, HP recorded total intangible asset impairment charges of $4.3 billion, of which

$3.1 billion was related to the Autonomy reporting unit as described above. The remaining $1.2 billion

was related to a change in the Compaq branding strategy. In May 2012, HP approved a change to its

branding strategy for PCs, which has resulted in a more limited and focused use of the ‘‘Compaq’’

trade name acquired in fiscal 2002. In conjunction with the change in branding strategy, HP revised its

assumption as to the useful life of that intangible asset, which resulted in a reclassification of the asset

from an indefinite-lived intangible to a finite- lived intangible. These changes triggered an impairment

review of the ‘‘Compaq’’ trade name intangible asset. In conducting an impairment review of an

intangible asset, HP compares the fair value of the asset to its carrying amount. If the fair value of the

asset is less than the carrying amount, the difference is recorded as an impairment loss. HP estimated

the fair value of the ‘‘Compaq’’ trade name by calculating the present value of the royalties saved that

would have been paid to a third party had HP not owned the trade name. Following the completion of

that analysis, HP determined that the fair value of the trade name asset was less than the carrying

amount due primarily to the change in the useful life assumption and a decrease in expected future

revenues related to Compaq-branded products resulting from the more focused branding strategy. As a

result, HP recorded an impairment charge of $1.2 billion in the third quarter of fiscal 2012, which was

included in the Impairment of goodwill and intangible assets line item in the Consolidated Statements

of Earnings.

138