HP 2014 Annual Report Download - page 150

Download and view the complete annual report

Please find page 150 of the 2014 HP annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.-

1

1 -

2

2 -

3

3 -

4

4 -

5

5 -

6

6 -

7

7 -

8

8 -

9

9 -

10

10 -

11

11 -

12

12 -

13

13 -

14

14 -

15

15 -

16

16 -

17

17 -

18

18 -

19

19 -

20

20 -

21

21 -

22

22 -

23

23 -

24

24 -

25

25 -

26

26 -

27

27 -

28

28 -

29

29 -

30

30 -

31

31 -

32

32 -

33

33 -

34

34 -

35

35 -

36

36 -

37

37 -

38

38 -

39

39 -

40

40 -

41

41 -

42

42 -

43

43 -

44

44 -

45

45 -

46

46 -

47

47 -

48

48 -

49

49 -

50

50 -

51

51 -

52

52 -

53

53 -

54

54 -

55

55 -

56

56 -

57

57 -

58

58 -

59

59 -

60

60 -

61

61 -

62

62 -

63

63 -

64

64 -

65

65 -

66

66 -

67

67 -

68

68 -

69

69 -

70

70 -

71

71 -

72

72 -

73

73 -

74

74 -

75

75 -

76

76 -

77

77 -

78

78 -

79

79 -

80

80 -

81

81 -

82

82 -

83

83 -

84

84 -

85

85 -

86

86 -

87

87 -

88

88 -

89

89 -

90

90 -

91

91 -

92

92 -

93

93 -

94

94 -

95

95 -

96

96 -

97

97 -

98

98 -

99

99 -

100

100 -

101

101 -

102

102 -

103

103 -

104

104 -

105

105 -

106

106 -

107

107 -

108

108 -

109

109 -

110

110 -

111

111 -

112

112 -

113

113 -

114

114 -

115

115 -

116

116 -

117

117 -

118

118 -

119

119 -

120

120 -

121

121 -

122

122 -

123

123 -

124

124 -

125

125 -

126

126 -

127

127 -

128

128 -

129

129 -

130

130 -

131

131 -

132

132 -

133

133 -

134

134 -

135

135 -

136

136 -

137

137 -

138

138 -

139

139 -

140

140 -

141

141 -

142

142 -

143

143 -

144

144 -

145

145 -

146

146 -

147

147 -

148

148 -

149

149 -

150

150 -

151

151 -

152

152 -

153

153 -

154

154 -

155

155 -

156

156 -

157

157 -

158

158 -

159

159 -

160

160 -

161

161 -

162

162 -

163

163 -

164

164 -

165

165 -

166

166 -

167

167 -

168

168 -

169

169 -

170

170 -

171

171 -

172

172 -

173

173 -

174

174 -

175

175 -

176

176 -

177

177 -

178

178 -

179

179 -

180

180 -

181

181 -

182

182 -

183

183 -

184

184 -

185

185 -

186

186 -

187

187 -

188

188 -

189

189 -

190

190 -

191

191 -

192

192 -

193

193 -

194

194 -

195

195 -

196

196

|

|

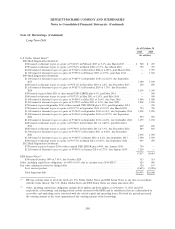

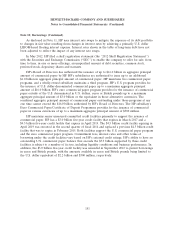

HEWLETT-PACKARD COMPANY AND SUBSIDIARIES

Notes to Consolidated Financial Statements (Continued)

Note 10: Fair Value (Continued)

have been paid to a third party had HP not owned the trade name. The discount rates used in the fair

value calculations for the Autonomy intangibles and the ‘‘Compaq’’ trade name were based on a

weighted average cost of capital adjusted for the relevant risk associated with those assets. The

unobservable inputs used in these valuations include projected revenue growth rates, operating margins,

royalty rates and the risk factor added to the discount rate. The discount rates ranged from 11% to

16%. Projected revenue growth rates ranged from (61)% to 13%. The (61)% rate reflected the

significant decline in expected future revenues for Compaq-branded products from fiscal 2013 to fiscal

2014 due to the change in branding strategy discussed in Note 9.

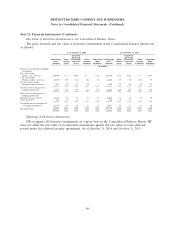

Note 11: Financial Instruments

Cash Equivalents and Available-for-Sale Investments

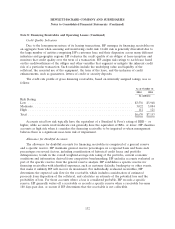

Cash equivalents and available-for-sale investments were as follows:

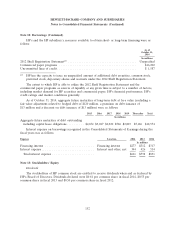

As of October 31, 2014 As of October 31, 2013

Gross Gross Gross Gross

Unrealized Unrealized Fair Unrealized Unrealized Fair

Cost Gain Loss Value Cost Gain Loss Value

In millions

Cash Equivalents:

Time deposits ........... $ 2,720 $— $ — $ 2,720 $2,207 $— $ — $2,207

Money market funds ...... 9,857 — — 9,857 6,819 — — 6,819

Mutual funds ........... 110 — — 110 13 — — 13

Total cash equivalents ....... 12,687 — — 12,687 9,039 — — 9,039

Available-for-Sale Investments:

Debt securities:

Time deposits ........... 145 — — 145 14 — — 14

Foreign bonds ........... 286 90 — 376 310 86 — 396

Other debt securities ...... 61 — (14) 47 64 — (15) 49

Total debt securities ........ 492 90 (14) 568 388 86 (15) 459

Equity securities:

Mutual funds ........... 134 — — 134 300 — — 300

Equity securities in public

companies ............ 8 7 — 15 5 6 — 11

Total equity securities ....... 142 7 — 149 305 6 — 311

Total available-for-sale

investments ............. 634 97 (14) 717 693 92 (15) 770

Total cash equivalents and

available-for-sale

investments ............. $13,321 $97 $(14) $13,404 $9,732 $92 $(15) $9,809

142