HP 2014 Annual Report Download - page 125

Download and view the complete annual report

Please find page 125 of the 2014 HP annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.-

1

1 -

2

2 -

3

3 -

4

4 -

5

5 -

6

6 -

7

7 -

8

8 -

9

9 -

10

10 -

11

11 -

12

12 -

13

13 -

14

14 -

15

15 -

16

16 -

17

17 -

18

18 -

19

19 -

20

20 -

21

21 -

22

22 -

23

23 -

24

24 -

25

25 -

26

26 -

27

27 -

28

28 -

29

29 -

30

30 -

31

31 -

32

32 -

33

33 -

34

34 -

35

35 -

36

36 -

37

37 -

38

38 -

39

39 -

40

40 -

41

41 -

42

42 -

43

43 -

44

44 -

45

45 -

46

46 -

47

47 -

48

48 -

49

49 -

50

50 -

51

51 -

52

52 -

53

53 -

54

54 -

55

55 -

56

56 -

57

57 -

58

58 -

59

59 -

60

60 -

61

61 -

62

62 -

63

63 -

64

64 -

65

65 -

66

66 -

67

67 -

68

68 -

69

69 -

70

70 -

71

71 -

72

72 -

73

73 -

74

74 -

75

75 -

76

76 -

77

77 -

78

78 -

79

79 -

80

80 -

81

81 -

82

82 -

83

83 -

84

84 -

85

85 -

86

86 -

87

87 -

88

88 -

89

89 -

90

90 -

91

91 -

92

92 -

93

93 -

94

94 -

95

95 -

96

96 -

97

97 -

98

98 -

99

99 -

100

100 -

101

101 -

102

102 -

103

103 -

104

104 -

105

105 -

106

106 -

107

107 -

108

108 -

109

109 -

110

110 -

111

111 -

112

112 -

113

113 -

114

114 -

115

115 -

116

116 -

117

117 -

118

118 -

119

119 -

120

120 -

121

121 -

122

122 -

123

123 -

124

124 -

125

125 -

126

126 -

127

127 -

128

128 -

129

129 -

130

130 -

131

131 -

132

132 -

133

133 -

134

134 -

135

135 -

136

136 -

137

137 -

138

138 -

139

139 -

140

140 -

141

141 -

142

142 -

143

143 -

144

144 -

145

145 -

146

146 -

147

147 -

148

148 -

149

149 -

150

150 -

151

151 -

152

152 -

153

153 -

154

154 -

155

155 -

156

156 -

157

157 -

158

158 -

159

159 -

160

160 -

161

161 -

162

162 -

163

163 -

164

164 -

165

165 -

166

166 -

167

167 -

168

168 -

169

169 -

170

170 -

171

171 -

172

172 -

173

173 -

174

174 -

175

175 -

176

176 -

177

177 -

178

178 -

179

179 -

180

180 -

181

181 -

182

182 -

183

183 -

184

184 -

185

185 -

186

186 -

187

187 -

188

188 -

189

189 -

190

190 -

191

191 -

192

192 -

193

193 -

194

194 -

195

195 -

196

196

|

|

HEWLETT-PACKARD COMPANY AND SUBSIDIARIES

Notes to Consolidated Financial Statements (Continued)

Note 4: Retirement and Post-Retirement Benefit Plans (Continued)

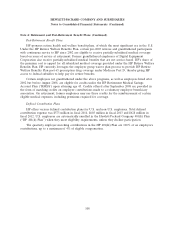

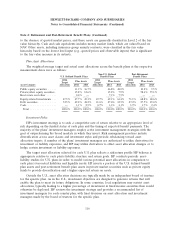

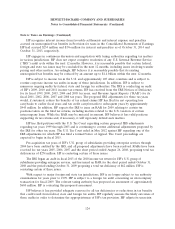

Basis for Expected Long-Term Rate of Return on Plan Assets

The expected long-term rate of return on plan assets reflects the expected returns for each major

asset class in which the plan invests and the weight of each asset class in the target mix. Expected asset

returns reflect the current yield on government bonds, risk premiums for each asset class and expected

real returns which considers each country’s specific inflation outlook. Because HP’s investment policy is

to employ primarily active investment managers who seek to outperform the broader market, the

expected returns are adjusted to reflect the expected additional returns net of fees.

Future Contributions and Funding Policy

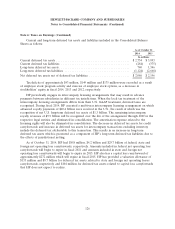

In fiscal 2015, HP expects to contribute approximately $686 million to its non-U.S. pension plans

and approximately $35 million to cover benefit payments to U.S. non-qualified plan participants. HP

expects to pay approximately $47 million to cover benefit claims for HP’s post-retirement benefit plans.

HP’s policy is to fund its pension plans so that it makes at least the minimum contribution required by

local government, funding and taxing authorities.

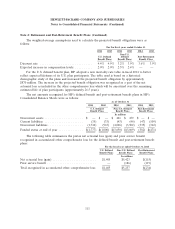

Estimated Future Benefits Payments

As of October 31, 2014, HP estimates that the future benefits payments for the retirement and

post-retirement plans are as follows:

Non-U.S.

U.S. Defined Defined Post-Retirement

Fiscal year Benefit Plans Benefit Plans Benefit Plans

In millions

2015 ........................................ $ 801 $ 567 $ 91

2016 ........................................ 588 528 94

2017 ........................................ 613 560 82

2018 ........................................ 648 606 71

2019 ........................................ 694 659 68

Next five fiscal years to October 31, 2024 ............... 3,850 3,980 278

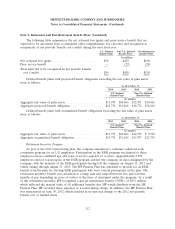

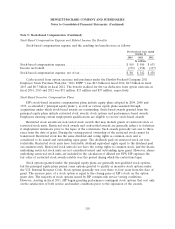

Note 5: Stock-Based Compensation

HP’s stock-based compensation plans include incentive compensation plans and an employee stock

purchase plan (‘‘ESPP’’).

117