HP 2014 Annual Report Download - page 156

Download and view the complete annual report

Please find page 156 of the 2014 HP annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

HEWLETT-PACKARD COMPANY AND SUBSIDIARIES

Notes to Consolidated Financial Statements (Continued)

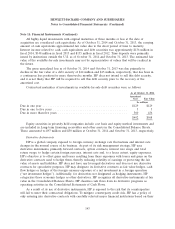

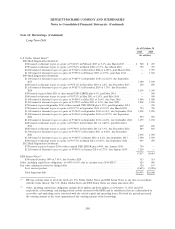

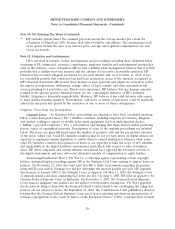

Note 11: Financial Instruments (Continued)

The pre-tax effect of derivative instruments in cash flow and net investment hedging relationships

for fiscal years ended October 31, 2014, 2013 and 2012 was as follows:

Gain (Loss)

Recognized in OCI

on Derivatives Gain (Loss) Reclassified from Accumulated OCI

(Effective Portion) Into Earnings (Effective Portion)

2014 2013 2012 Location 2014 2013 2012

In millions In millions

Cash flow hedges:

Foreign currency contracts .... $593 $ (53)$415 Net revenue $ (21) $ 48 $423

Foreign currency contracts .... (203) (192) (65) Cost of products (71) (165) (15)

Foreign currency contracts .... 7 (19) (7)Other operating expenses (9) 1 (6)

Foreign currency contracts .... (60) 21 (8)Interest and other, net (50) 10 (3)

Total currency hedges ...... $337 $(243) $335 $(151) $(106) $399

Net investment hedges:

Foreign currency contracts .... $ 57 $ 38 $ 37 Interest and other, net $ — $ — $ —

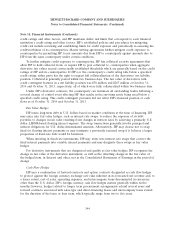

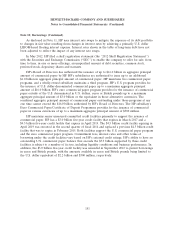

As of October 31, 2014 and October 31, 2013, no portion of the hedging instruments’ gain or loss

was excluded from the assessment of effectiveness for fair value, cash flow or net investment hedges.

As of October 31, 2012 the portion of the hedging instruments’ gain or loss excluded from the

assessment of effectiveness was not material for fair value, cash flow or net investment hedges. Hedge

ineffectiveness for fair value, cash flow and net investment hedges was not material for fiscal 2014, 2013

and 2012.

As of October 31, 2014, HP expects to reclassify an estimated net Accumulated other

comprehensive gain of approximately $185 million, net of taxes, to earnings in the next twelve months

along with the earnings effects of the related forecasted transactions associated with cash flow hedges.

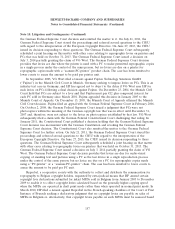

The pre-tax effect of derivative instruments not designated as hedging instruments on the

Consolidated Statements of Earnings for fiscal years ended October 31, 2014, 2013 and 2012 was as

follows:

Gain (Loss) Recognized in Income on Derivatives

Location 2014 2013 2012

In millions

Foreign currency contracts ....................... Interest and other, net $56 $166 $171

Other derivatives .............................. Interest and other, net — 11 (32)

Interest rate contracts .......................... Interest and other, net — 3 13

Total ...................................... $56 $180 $152

148