HP 2014 Annual Report Download - page 126

Download and view the complete annual report

Please find page 126 of the 2014 HP annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

HEWLETT-PACKARD COMPANY AND SUBSIDIARIES

Notes to Consolidated Financial Statements (Continued)

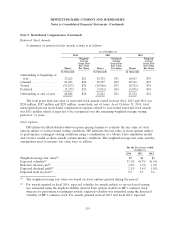

Note 5: Stock-Based Compensation (Continued)

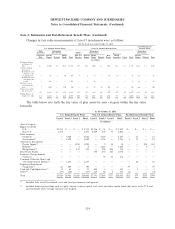

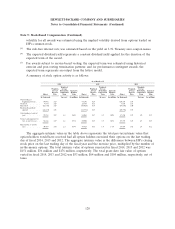

Stock-Based Compensation Expense and Related Income Tax Benefits

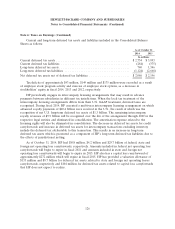

Stock-based compensation expense and the resulting tax benefits were as follows:

For the fiscal years ended

October 31

2014 2013 2012

In millions

Stock-based compensation expense ................................. $560 $500 $635

Income tax benefit ............................................ (179) (158) (197)

Stock-based compensation expense, net of tax ......................... $381 $342 $438

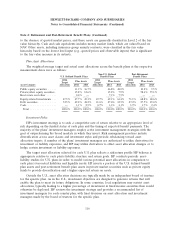

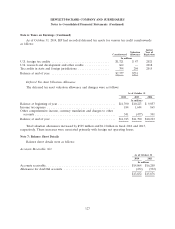

Cash received from option exercises and purchases under the Hewlett-Packard Company 2011

Employee Stock Purchase Plan (the ‘‘2011 ESPP’’) was $0.3 billion in fiscal 2014, $0.3 billion in fiscal

2013 and $0.7 billion in fiscal 2012. The benefit realized for the tax deduction from option exercises in

fiscal 2014, 2013 and 2012 was $51 million, $13 million and $57 million, respectively.

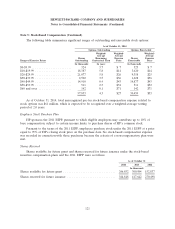

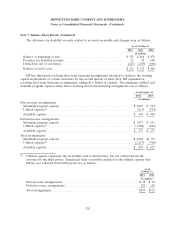

Stock-Based Incentive Compensation Plans

HP’s stock-based incentive compensation plans include equity plans adopted in 2004, 2000 and

1995, as amended (‘‘principal equity plans’’), as well as various equity plans assumed through

acquisitions under which stock-based awards are outstanding. Stock-based awards granted from the

principal equity plans include restricted stock awards, stock options and performance-based awards.

Employees meeting certain employment qualifications are eligible to receive stock-based awards.

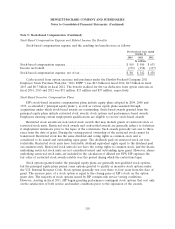

Restricted stock awards are non-vested stock awards that may include grants of restricted stock or

restricted stock units. Restricted stock awards and cash-settled awards are generally subject to forfeiture

if employment terminates prior to the lapse of the restrictions. Such awards generally vest one to three

years from the date of grant. During the vesting period, ownership of the restricted stock cannot be

transferred. Restricted stock has the same dividend and voting rights as common stock and is

considered to be issued and outstanding upon grant. The dividends paid on restricted stock are non-

forfeitable. Restricted stock units have forfeitable dividend equivalent rights equal to the dividend paid

on common stock. Restricted stock units do not have the voting rights of common stock, and the shares

underlying restricted stock units are not considered issued and outstanding upon grant. However, shares

underlying restricted stock units are included in the calculation of diluted net EPS. HP expenses the

fair value of restricted stock awards ratably over the period during which the restrictions lapse.

Stock options granted under the principal equity plans are generally non-qualified stock options,

but the principal equity plans permit some options granted to qualify as incentive stock options under

the U.S. Internal Revenue Code. Stock options generally vest over three to four years from the date of

grant. The exercise price of a stock option is equal to the closing price of HP’s stock on the option

grant date. The majority of stock options issued by HP contain only service vesting conditions.

However, starting in fiscal 2011, HP began granting performance-contingent stock options that vest only

on the satisfaction of both service and market conditions prior to the expiration of the awards.

118