HP 2014 Annual Report Download - page 50

Download and view the complete annual report

Please find page 50 of the 2014 HP annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.ITEM 7. Management’s Discussion and Analysis of Financial Condition and Results of Operations.

HEWLETT-PACKARD COMPANY AND SUBSIDIARIES

Management’s Discussion and Analysis of

Financial Condition and Results of Operations

This Management’s Discussion and Analysis of Financial Condition and Results of Operations

(‘‘MD&A’’) is organized as follows:

•Overview. A discussion of our business and overall analysis of financial and other highlights

affecting the company to provide context for the remainder of MD&A. The overview analysis

compares fiscal 2014 to fiscal 2013.

•Critical Accounting Policies and Estimates. A discussion of accounting policies and estimates that

we believe are important to understanding the assumptions and judgments incorporated in our

reported financial results.

•Results of Operations. An analysis of our financial results comparing fiscal 2014 and fiscal 2013

to the prior years. A discussion of the results of operations at the consolidated level is followed

by a more detailed discussion of the results of operations by segment.

•Liquidity and Capital Resources. An analysis of changes in our cash flows and a discussion of our

financial condition and liquidity.

•Contractual and Other Obligations. An overview of contractual obligations, retirement and

post-retirement benefit plan funding, restructuring plans, uncertain tax positions and off-balance

sheet arrangements.

We intend the discussion of our financial condition and results of operations that follows to

provide information that will assist the reader in understanding our Consolidated Financial Statements,

the changes in certain key items in those financial statements from year to year, and the primary

factors that accounted for those changes, as well as how certain accounting principles, policies and

estimates affect our Consolidated Financial Statements. This discussion should be read in conjunction

with our Consolidated Financial Statements and the related notes that appear elsewhere in this

document.

October 2014 Announcement of HP Separation Transaction

On October 6, 2014, we announced plans to separate into two independent publicly-traded

companies: one comprising our enterprise technology infrastructure, software, services and financing

businesses, which will conduct business as Hewlett-Packard Enterprise and one that will comprise our

printing and personal systems businesses, which will conduct business as HP Inc. The separation is

subject to certain conditions, including, among others, obtaining final approval from HP’s Board of

Directors, receipt of a favorable opinion and/or rulings with respect to the tax-free nature of the

transaction for federal income tax purposes and the effectiveness of a Form 10 filing with the SEC. The

separation is expected to be completed by the end of fiscal 2015. Under the separation plan, HP

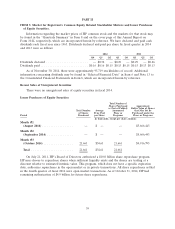

shareholders will own shares of both Hewlett-Packard Enterprise and HP Inc. The following chart

provides an overview of the planned separation and segment revenues of the respective businesses

based on HP’s fiscal 2014 results, excluding Corporate Investments and intercompany eliminations.

42