HP 2014 Annual Report Download - page 134

Download and view the complete annual report

Please find page 134 of the 2014 HP annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

HEWLETT-PACKARD COMPANY AND SUBSIDIARIES

Notes to Consolidated Financial Statements (Continued)

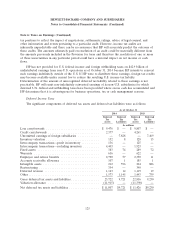

Note 6: Taxes on Earnings (Continued)

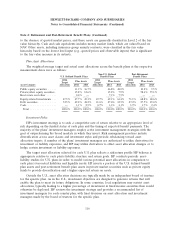

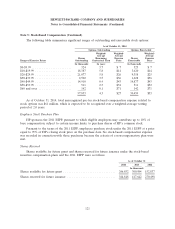

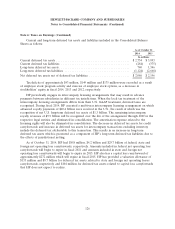

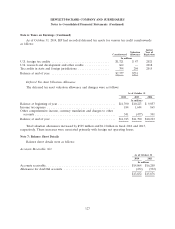

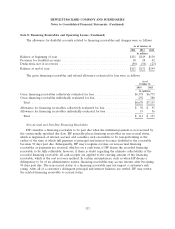

Current and long-term deferred tax assets and liabilities included in the Consolidated Balance

Sheets as follows:

As of October 31

2014 2013

In millions

Current deferred tax assets .......................................... $2,754 $ 3,893

Current deferred tax liabilities ....................................... (284) (375)

Long-term deferred tax assets ........................................ 740 1,346

Long-term deferred tax liabilities ..................................... (1,124) (2,668)

Net deferred tax assets net of deferred tax liabilities ....................... $2,086 $ 2,196

Tax deficits of approximately $43 million, $149 million and $175 million were recorded as a result

of employee stock program activity and exercise of employee stock options, as a decrease in

stockholders’ equity in fiscal 2014, 2013 and 2012, respectively.

HP periodically engages in intercompany licensing arrangements that may result in advance

payments between subsidiaries in different tax jurisdictions. When the local tax treatment of the

intercompany licensing arrangements differs from their U.S. GAAP treatment, deferred taxes are

recognized. During fiscal 2014, HP executed a multi-year intercompany licensing arrangement on which

advanced royalty payments of $10.4 billion were received in the U.S., the result of which was the

recognition of net U.S. long-term deferred tax assets of $1.3 billion. The remaining intercompany

royalty revenues of $9.9 billion will be recognized over the life of the arrangement through 2029 in the

respective legal entities and eliminated in consolidation. The amortization expense related to the

licensing rights will also be eliminated in consolidation. The decrease in deferred tax assets for credit

carryforwards and increase in deferred tax assets for intercompany transactions excluding inventory

include the deferred tax attributable to this transaction. This results in an increase in long-term

deferred tax assets which is presented as a component of HP’s long-term deferred tax liabilities due to

the effects of jurisdictional netting.

As of October 31, 2014, HP had $858 million, $4.2 billion and $29.7 billion of federal, state and

foreign net operating loss carryforwards, respectively. Amounts included in federal net operating loss

carryforwards will begin to expire in fiscal 2021 and amounts included in state and foreign net

operating loss carryforwards will begin to expire in 2015. HP also has a capital loss carryforward of

approximately $272 million which will expire in fiscal 2015. HP has provided a valuation allowance of

$133 million and $8.7 billion for deferred tax assets related to state and foreign net operating losses

carryforwards, respectively and $104 million for deferred tax assets related to capital loss carryforwards

that HP does not expect to realize.

126