HP 2014 Annual Report Download - page 72

Download and view the complete annual report

Please find page 72 of the 2014 HP annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

HEWLETT-PACKARD COMPANY AND SUBSIDIARIES

Management’s Discussion and Analysis of

Financial Condition and Results of Operations (Continued)

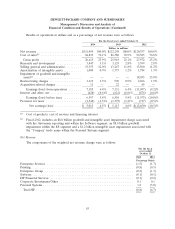

Enterprise Group

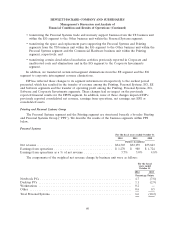

For the fiscal years ended October 31

2014 2013 2012

Dollars in millions

Net revenue ........................................... $27,814 $28,081 $29,643

Earnings from operations ................................. $ 4,008 $ 4,259 $ 5,123

Earnings from operations as a % of net revenue ................ 14.4% 15.2% 17.3%

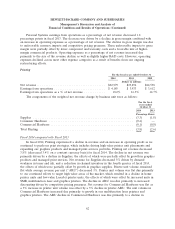

The components of the weighted net revenue change by business unit were as follows for the

following fiscal years ended October 31:

For the fiscal

years ended

October 31

2014 2013

Percentage Points

Technology Services ................................................. (1.1) (1.3)

Business Critical Systems ............................................. (0.9) (1.4)

Storage .......................................................... (0.6) (1.1)

Networking ....................................................... 0.3 0.1

Industry Standard Servers ............................................. 1.3 (1.6)

Total Enterprise Group .............................................. (1.0) (5.3)

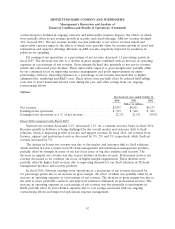

Fiscal 2014 compared with Fiscal 2013

EG net revenue decreased 1.0% (decreased 0.6% on a constant currency basis) in fiscal 2014. In

EG, we continue to experience revenue challenges due to market trends, including the transition to

cloud computing, as well as product and technology transitions, along with a highly competitive pricing

environment. The decline in EG net revenue was due to net revenue declines in TS, BCS and Storage

partially offset by net revenue growth in ISS and Networking.

TS net revenue decreased 4% due primarily to a continued reduction in support for BCS,

traditional storage products and lower support in networking services, partially offset by growth in

support solutions for converged storage solutions and ISS. BCS net revenue decreased 22% as a result

of ongoing pressures from the overall UNIX market contraction. Storage net revenue decreased by 5%

as we continue to experience multiple challenges including product transitions from traditional storage

products which include our tape, storage networking and legacy external disk products, to converged

solutions, which include our 3PAR StoreServ, StoreOnce, and StoreVirtual products, other challenges

include market weakness in high-end converged solutions and sales execution challenges, the effects of

which were partially offset by revenue growth in our Converged Storage solutions. Networking net

revenue increased 4% due to higher switching product revenue as a result of growth in our data center

products, partially offset by lower revenue from wireless local area network products. ISS net revenue

increased by 3% due primarily to higher volume and higher average unit prices in rack and blade

server products driven by higher option attach rates for memory, processors and hard drives.

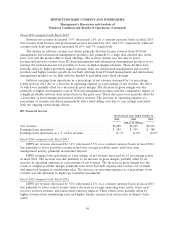

EG earnings from operations as a percentage of net revenue decreased by 0.8 percentage points in

fiscal 2014 due to a decrease in gross margin coupled with an increase in operating expenses as a

percentage of net revenue. The gross margin decline was due primarily to a higher mix of ISS products,

a lower mix of BCS products and competitive pricing pressure in ISS and Networking, partially offset

64