HP 2014 Annual Report Download - page 127

Download and view the complete annual report

Please find page 127 of the 2014 HP annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

HEWLETT-PACKARD COMPANY AND SUBSIDIARIES

Notes to Consolidated Financial Statements (Continued)

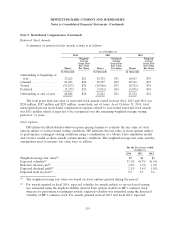

Note 5: Stock-Based Compensation (Continued)

Restricted Stock Awards

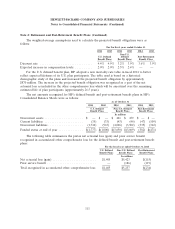

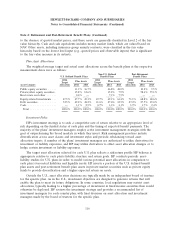

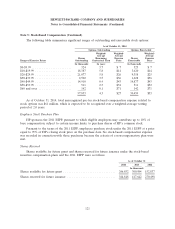

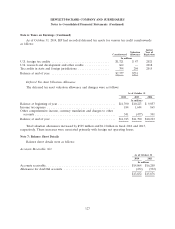

A summary of restricted stock awards activity is as follows:

As of October 31

2014 2013 2012

Weighted- Weighted- Weighted-

Average Average Average

Grant Date Grant Date Grant Date

Fair Value Fair Value Fair Value

Shares Per Share Shares Per Share Shares Per Share

In thousands In thousands In thousands

Outstanding at beginning of

year ................ 32,262 $21 25,532 $31 16,813 $39

Granted ............... 26,036 $28 20,707 $15 20,316 $27

Vested ................ (14,253) $24 (10,966) $33 (8,521) $38

Forfeited .............. (3,237) $22 (3,011) $24 (3,076) $34

Outstanding at end of year . 40,808 $24 32,262 $21 25,532 $31

The total grant date fair value of restricted stock awards vested in fiscal 2014, 2013 and 2012 was

$234 million, $247 million and $229 million, respectively, net of taxes. As of October 31, 2014, total

unrecognized pre-tax stock-based compensation expense related to non-vested restricted stock awards

was $511 million, which is expected to be recognized over the remaining weighted-average vesting

period of 1.4 years.

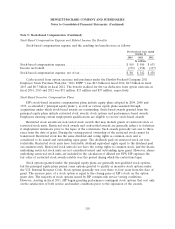

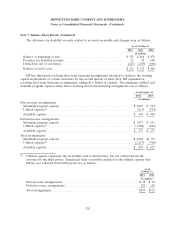

Stock Options

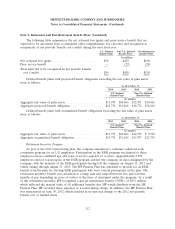

HP utilizes the Black-Scholes-Merton option pricing formula to estimate the fair value of stock

options subject to service-based vesting conditions. HP estimates the fair value of stock options subject

to performance-contingent vesting conditions using a combination of a Monte Carlo simulation model

and a lattice model as these awards contain market conditions. The weighted-average fair value and the

assumptions used to measure fair value were as follows:

For the fiscal years ended

October 31

2014 2013 2012

Weighted-average fair value(1) .................................... $7 $4 $9

Expected volatility(2) .......................................... 33.1% 41.7% 41.9%

Risk-free interest rate(3) ........................................ 1.8% 1.1% 1.2%

Expected dividend yield(4) ....................................... 2.1% 3.6% 1.8%

Expected term in years(5) ....................................... 5.7 5.9 5.6

(1) The weighted-average fair value was based on stock options granted during the period.

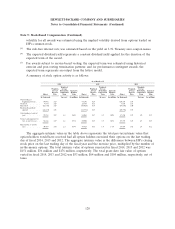

(2) For awards granted in fiscal 2014, expected volatility for awards subject to service-based vesting

was estimated using the implied volatility derived from options traded on HP’s common stock,

whereas for performance-contingent awards, expected volatility was estimated using the historical

volatility of HP’s common stock. For awards granted in fiscal 2013 and fiscal 2012, expected

119