HP 2014 Annual Report Download - page 102

Download and view the complete annual report

Please find page 102 of the 2014 HP annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.HEWLETT-PACKARD COMPANY AND SUBSIDIARIES

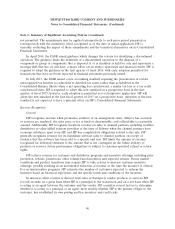

Notes to Consolidated Financial Statements (Continued)

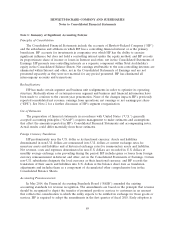

Note 1: Summary of Significant Accounting Policies (Continued)

gains and losses using the corridor approach. See Note 4 for a full description of these plans and the

accounting and funding policies.

Advertising

Costs to produce advertising are expensed as incurred during production. Costs to communicate

advertising are expensed when the advertising is first run. Such costs totaled approximately $784 million

in fiscal 2014, $878 million in fiscal 2013 and $1.0 billion in fiscal 2012.

Restructuring

HP records charges associated with management-approved restructuring plans to reorganize one or

more of HP’s business segments, to remove duplicative headcount and infrastructure associated with

business acquisitions or to simplify business processes and accelerate innovation. Restructuring charges

can include severance costs to eliminate a specified number of employees, infrastructure charges to

vacate facilities and consolidate operations, and contract cancellation costs. HP records restructuring

charges based on estimated employee terminations and site closure and consolidation plans. HP accrues

for severance and other employee separation costs under these actions when it is probable that benefits

will be paid and the amount is reasonably estimable. The rates used in determing severance accruals

are based on existing plans, historical experiences and negotiated settlements.

Taxes on Earnings

HP recognizes deferred tax assets and liabilities for the expected tax consequences of temporary

differences between the tax bases of assets and liabilities and their reported amounts using enacted tax

rates in effect for the year the differences are expected to reverse. HP records a valuation allowance to

reduce the deferred tax assets to the amount that is more likely than not to be realized.

HP records accruals for uncertain tax positions when HP believes that it is not more likely than

not that the tax position will be sustained on examination by the taxing authorities based on the

technical merits of the position. HP makes adjustments to these accruals when facts and circumstances

change, such as the closing of a tax audit or the refinement of an estimate. The provision for income

taxes includes the effects of adjustments for uncertain tax positions, as well as any related interest and

penalties.

Accounts Receivable

HP establishes an allowance for doubtful accounts for accounts receivable. HP records a specific

reserve for individual accounts when HP becomes aware of specific customer circumstances, such as in

the case of a bankruptcy filing or deterioration in the customer’s operating results or financial position.

If there are additional changes in circumstances related to the specific customer, HP further adjusts

estimates of the recoverability of receivables. HP maintains bad debt reserves for all other customers

based on a variety of factors, including the use of third-party credit risk models that generate

quantitative measures of default probabilities based on market factors, the financial condition of

customers, the length of time receivables are past due, trends in the weighted-average risk rating for

the portfolio, macroeconomic conditions, information derived from competitive benchmarking,

significant one-time events and historical experience. The past due or delinquency status of a receivable

is based on the contractual payment terms of the receivable.

94