HP 2014 Annual Report Download - page 148

Download and view the complete annual report

Please find page 148 of the 2014 HP annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

HEWLETT-PACKARD COMPANY AND SUBSIDIARIES

Notes to Consolidated Financial Statements (Continued)

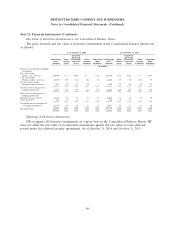

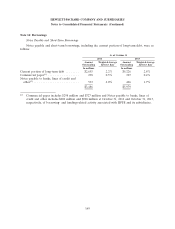

Note 10: Fair Value (Continued)

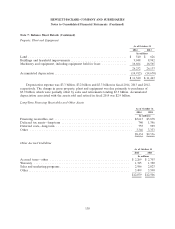

The following table presents HP’s assets and liabilities that are measured at fair value on a

recurring basis:

As of October 31, 2014 As of October 31, 2013

Fair Value Fair Value

Measured Using Measured Using

Level 1 Level 2 Level 3 Total Level 1 Level 2 Level 3 Total

In millions

Assets

Cash Equivalents and Investments:

Time deposits .................. $ — $2,865 $— $ 2,865 $ — $2,221 $— $ 2,221

Money market funds ............. 9,857 — — 9,857 6,819 — — 6,819

Mutual funds ................... — 244 — 244 — 313 — 313

Marketable equity securities ........ 14 5 — 19 10 5 — 15

Foreign bonds .................. 9 367 — 376 9 387 — 396

Other debt securities ............. — 1 46 47 — 2 47 49

Derivatives:

Interest rate contracts ............. — 105 — 105 — 156 — 156

Foreign exchange contracts ......... — 862 6 868 — 284 3 287

Other derivatives ................ — 7 — 7 — 9 — 9

Total assets ................... $9,880 $4,456 $52 $14,388 $6,838 $3,377 $50 $10,265

Liabilities

Derivatives:

Interest rate contracts ............. $ — $ 55 $— $ 55 $ — $ 107 $— $ 107

Foreign exchange contracts ......... — 348 2 350 — 547 2 549

Total liabilities ................ $ — $ 403 $ 2 $ 405 $ — $ 654 $ 2 $ 656

For the year ended October 31, 2014, there were no transfers between levels within the fair value

hierarchy.

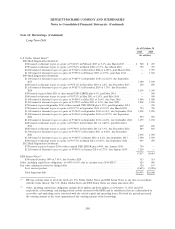

Valuation Techniques

Cash Equivalents and Investments: HP holds time deposits, money market funds, mutual funds,

other debt securities primarily consisting of corporate and foreign government notes and bonds, and

common stock and equivalents. HP values cash equivalents and equity investments using quoted market

prices, alternative pricing sources, including NAV, or models utilizing market observable inputs. The fair

value of debt investments was based on quoted market prices or model-driven valuations using inputs

primarily derived from or corroborated by observable market data, and, in certain instances, valuation

models that utilize assumptions which cannot be corroborated with observable market data.

Derivative Instruments: HP uses forward contracts, interest rate and total return swaps and

option contracts to hedge certain foreign currency and interest rate exposures. HP uses industry

standard valuation models to measure fair value. Where applicable, these models project future cash

flows and discount the future amounts to present value using market-based observable inputs, including

interest rate curves, HP and counterparty credit risk, foreign exchange rates, and forward and spot

prices for currencies and interest rates. See Note 11 for a further discussion of HP’s use of derivative

instruments.

140