HP 2014 Annual Report Download - page 112

Download and view the complete annual report

Please find page 112 of the 2014 HP annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

HEWLETT-PACKARD COMPANY AND SUBSIDIARIES

Notes to Consolidated Financial Statements (Continued)

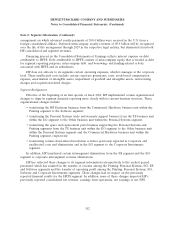

Note 2: Segment Information (Continued)

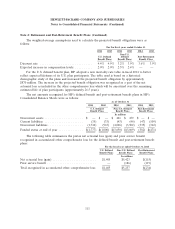

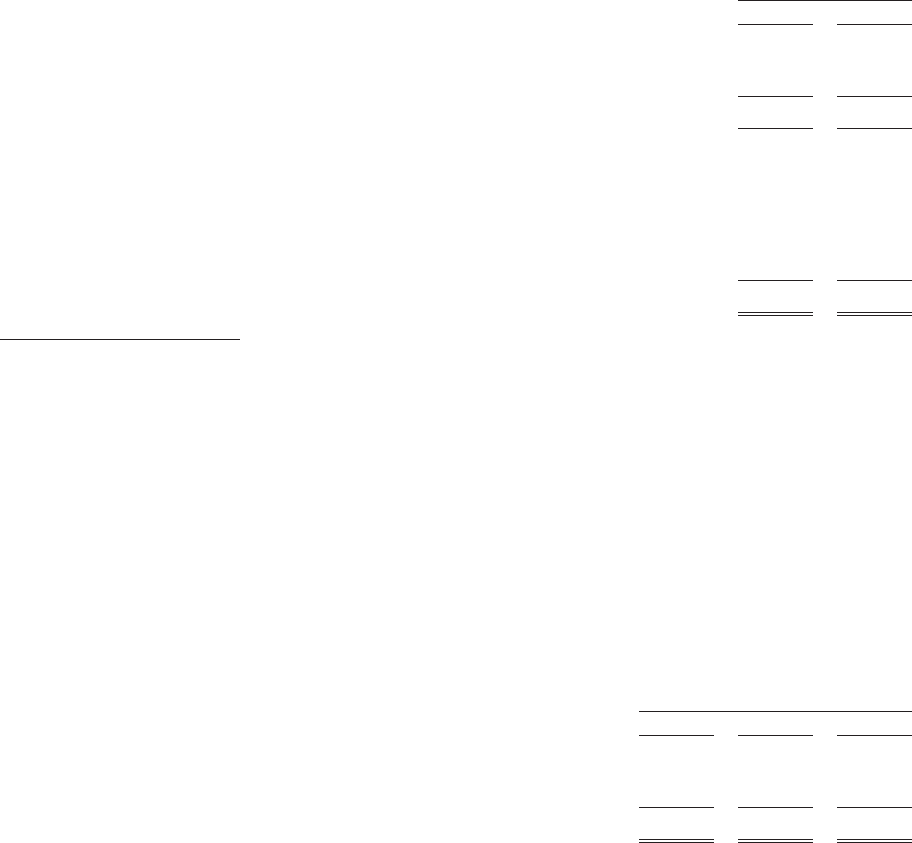

Segment Assets

HP allocates assets to its business segments based on the segments primarily benefiting from the

assets. Total assets by segment and the reconciliation of segment assets to HP consolidated assets were

as follows:

As of October 31

2014 2013(1)

In millions

Personal Systems ............................................... $ 12,104 $ 11,690

Printing ...................................................... 10,063 11,088

Printing and Personal Systems Group .............................. 22,167 22,778

Enterprise Group .............................................. 27,236 29,759

Enterprise Services ............................................. 13,472 16,217

Software ..................................................... 11,575 11,940

HP Financial Services ........................................... 13,529 12,746

Corporate Investments ........................................... 34 105

Corporate and unallocated assets ................................... 15,193 12,131

Total HP consolidated assets ................................... $103,206 $105,676

(1) HP has revised the presentation for the fiscal year ended October 31, 2013 in order to present

comparable information with the current year period.

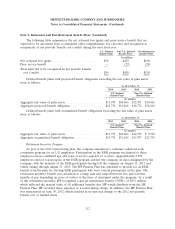

Major Customers

No single customer represented 10% or more of HP’s total net revenue in any fiscal year

presented.

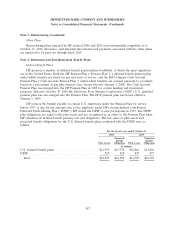

Geographic Information

Net revenue by country is based upon the sales location that predominately represents the

customer location. For each of the fiscal years of 2014, 2013 and 2012, other than the U.S., no country

represented more than 10% of HP net revenue.

Net revenue by country in which HP operates was as follows:

For the fiscal years ended October 31

2014 2013 2012

In millions

U.S................................................. $ 38,805 $ 40,284 $ 42,140

Other countries ........................................ 72,649 72,014 78,217

Total net revenue ..................................... $111,454 $112,298 $120,357

As of October 31, 2014, the U.S., Netherlands and Ireland each represented more than 10% of net

assets. As of October 31, 2013, the U.S., the Cayman Islands and Ireland each represented 10% or

more of net assets.

104