HP 2014 Annual Report Download - page 163

Download and view the complete annual report

Please find page 163 of the 2014 HP annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

HEWLETT-PACKARD COMPANY AND SUBSIDIARIES

Notes to Consolidated Financial Statements (Continued)

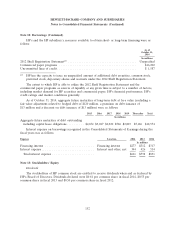

Note 13: Stockholders’ Equity (Continued)

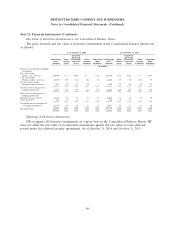

The components of accumulated other comprehensive loss, net of taxes as of October 31, 2014 and

changes during fiscal year 2014 were as follows:

Net unrealized Unrealized Accumulated

gain on Net unrealized components Cumulative other

available-for-sale loss on cash of defined translation comprehensive

securities flow hedges benefit plans adjustment loss

In millions

Balance at beginning of period . . $76 $(188) $(3,084) $(582) $(3,778)

Other comprehensive income

(loss) before reclassifications . . 6 163 (2,533) (112) (2,479)

Reclassifications of (gains) losses

into earnings ............. (1) 133 241 — 376

Balance at end of period ...... $81 $108 $(5,376) $(694) $(5,881)

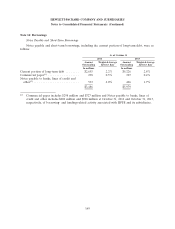

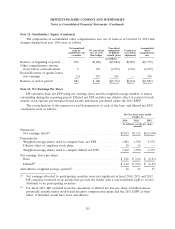

Note 14: Net Earnings Per Share

HP calculates basic net EPS using net earnings (loss) and the weighted-average number of shares

outstanding during the reporting period. Diluted net EPS includes any dilutive effect of restricted stock

awards, stock options, performance-based awards and shares purchased under the 2011 ESPP.

The reconciliations of the numerators and denominators of each of the basic and diluted net EPS

calculations were as follows:

For the fiscal years ended

October 31

2014 2013 2012

In millions, except per share

amounts

Numerator:

Net earnings (loss)(1) ...................................... $5,013 $5,113 $(12,650)

Denominator:

Weighted-average shares used to compute basic net EPS ............ 1,882 1,934 1,974

Dilutive effect of employee stock plans ........................ 30 16 —

Weighted-average shares used to compute diluted net EPS .......... 1,912 1,950 1,974

Net earnings (loss) per share:

Basic ................................................. $ 2.66 $ 2.64 $ (6.41)

Diluted(2) .............................................. $ 2.62 $ 2.62 $ (6.41)

Anti-dilutive weighted average options(3) ......................... 26 52 57

(1) Net earnings allocated to participating securities were not significant in fiscal 2014, 2013 and 2012.

HP considers restricted stock awards that provide the holder with a non-forfeitable right to receive

dividends to be participating securities.

(2) For fiscal 2012, HP excluded from the calculation of diluted net loss per share 10 million shares

potentially issuable under stock-based incentive compensation plans and the 2011 ESPP, as their

effect, if included, would have been anti-dilutive.

155