HP 2014 Annual Report Download - page 144

Download and view the complete annual report

Please find page 144 of the 2014 HP annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.HEWLETT-PACKARD COMPANY AND SUBSIDIARIES

Notes to Consolidated Financial Statements (Continued)

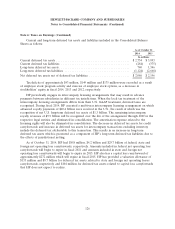

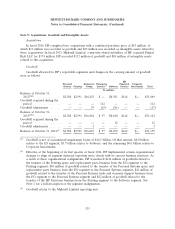

Note 9: Acquisitions, Goodwill and Intangible Assets (Continued)

Goodwill is tested for impairment at the reporting unit level. At the beginning of its first quarter

of fiscal 2014, HP made a change to its reporting units. In connection with continued operational

synergies and interdependencies between the Enterprise Servers, Storage and Networking reporting unit

and the TS reporting unit within the EG segment, HP combined these reporting units to create the EG

reporting unit. As of October 31, 2014, HP’s reporting units are consistent with the reportable

segments identified in Note 2, except for ES, which includes two reporting units: MphasiS Limited; and

the remainder of ES.

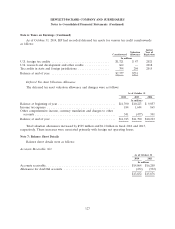

Based on the results of its annual impairment tests, HP determined that no impairment of

goodwill existed as of August 1, 2014. However, future goodwill impairment tests could result in a

charge to earnings. HP will continue to evaluate goodwill on an annual basis as of the beginning of its

fourth fiscal quarter and whenever events or changes in circumstances indicate there may be a potential

impairment.

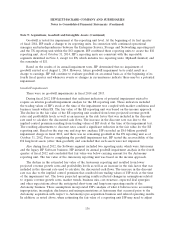

Goodwill impairments

There were no goodwill impairments in fiscal 2014 and 2013.

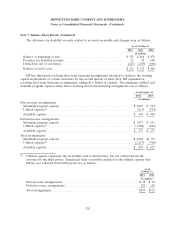

During fiscal 2012, HP determined that sufficient indicators of potential impairment existed to

require an interim goodwill impairment analysis for the ES reporting unit. These indicators included

the trading values of HP’s stock at the time of the impairment test, coupled with market conditions and

business trends within ES. The fair value of the ES reporting unit was based on the income approach.

The decline in the fair value of the ES reporting unit resulted from lower projected revenue growth

rates and profitability levels as well as an increase in the risk factor that was included in the discount

rate used to calculate the discounted cash flows. The increase in the discount rate was due to the

implied control premium resulting from trading values of HP stock at the time of the impairment test.

The resulting adjustments to discount rates caused a significant reduction in the fair value for the ES

reporting unit. Based on the step one and step two analyses, HP recorded an $8.0 billion goodwill

impairment charge in fiscal 2012, and there was no remaining goodwill in the ES reporting unit as of

October 31, 2012. Prior to completing the goodwill impairment test, HP tested the recoverability of the

ES long-lived assets (other than goodwill) and concluded that such assets were not impaired.

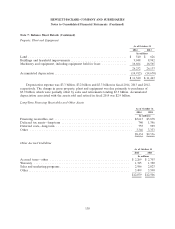

Also during fiscal 2012, the Software segment included two reporting units, which were Autonomy

and the legacy HP Software business. HP initiated its annual goodwill impairment analysis in the fourth

quarter of fiscal 2012 and concluded that fair value was below carrying amount for the Autonomy

reporting unit. The fair value of the Autonomy reporting unit was based on the income approach.

The decline in the estimated fair value of the Autonomy reporting unit resulted from lower

projected revenue growth rates and profitability levels as well as an increase in the risk factor that was

included in the discount rate used to calculate the discounted cash flows. The increase in the discount

rate was due to the implied control premium that resulted from trading values of HP stock at the time

of the impairment test. The lower projected operating results reflected changes in assumptions related

to organic revenue growth rates, market trends, business mix, cost structure, expected deal synergies

and other expectations about the anticipated short-term and long-term operating results of the

Autonomy business. These assumptions incorporated HP’s analysis of what it believes were accounting

improprieties, incomplete disclosures and misrepresentations at Autonomy that occurred prior to the

Autonomy acquisition with respect to Autonomy’s pre-acquisition business and related operating results.

In addition, as noted above, when estimating the fair value of a reporting unit HP may need to adjust

136