HP 2014 Annual Report Download - page 79

Download and view the complete annual report

Please find page 79 of the 2014 HP annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

HEWLETT-PACKARD COMPANY AND SUBSIDIARIES

Management’s Discussion and Analysis of

Financial Condition and Results of Operations (Continued)

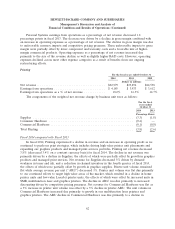

Corporate Investments

For the fiscal years ended October 31

2014 2013 2012

Dollars in millions

Net revenue $ 302 $ 24 $ 58

Loss from operations .................................... $(199) $(316) $(233)

Loss from operations as a % of net revenue(1) .................. (66.0)% NM NM

(1) ‘‘NM’’ represents not meaningful.

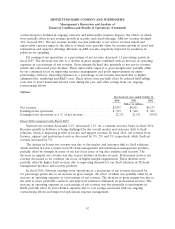

Fiscal 2014 compared with Fiscal 2013

The revenue increase for fiscal 2014 was due primarily to the sale of IP related to the Palm

acquisition.

The decrease in the loss from operations for fiscal 2014 was due primarily to the sale of IP, the

benefits of which were partially offset by higher expenses associated with cloud-related incubation

activities, corporate strategy, HP Labs and global alliances.

Fiscal 2013 compared with Fiscal 2012

In fiscal 2013, Corporate Investments net revenue was primarily related to licensing revenue from

HP Labs. Net revenue decreased from fiscal 2012 due primarily to lower residual activity from the

webOS device business and lower revenue from business intelligence products.

Costs and expenses in Corporate Investments are due to activities in the segment from residual

activity related to the webOS device business, HP Labs, certain incubation projects, corporate strategy,

and global alliances.

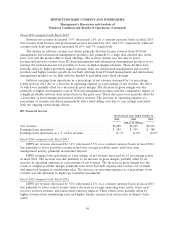

LIQUIDITY AND CAPITAL RESOURCES

We use cash generated by operations as our primary source of liquidity. We believe that internally

generated cash flows are generally sufficient to support our operating businesses, capital expenditures,

restructuring activities, maturing debt, income tax payments and the payment of stockholder dividends,

in addition to investments and share repurchases. We are able to supplement this short-term liquidity,

if necessary, with broad access to capital markets and credit facilities made available by various

domestic and foreign financial institutions. Our access to capital markets may be constrained and our

cost of borrowing may increase under certain business, market and economic conditions; however, our

access to a variety of funding sources to meet our liquidity needs is designed to facilitate continued

access to capital resources under all such conditions. Our liquidity is subject to various risks including

the risks identified in the section entitled ‘‘Risk Factors’’ in Item 1A and market risks identified in the

section entitled ‘‘Quantitative and Qualitative Disclosures about Market Risk’’ in Item 7A, which is

incorporated herein by reference.

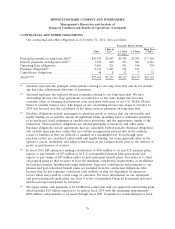

Our cash balances are held in numerous locations throughout the world, with substantially all of

those amounts held outside of the U.S. We utilize a variety of planning and financing strategies in an

effort to ensure that our worldwide cash is available when and where it is needed. Our cash position

remains strong, and we expect that our cash balances, anticipated cash flow generated from operations

and access to capital markets will be sufficient to cover our expected near-term cash outlays.

71