HP 2014 Annual Report Download - page 124

Download and view the complete annual report

Please find page 124 of the 2014 HP annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

HEWLETT-PACKARD COMPANY AND SUBSIDIARIES

Notes to Consolidated Financial Statements (Continued)

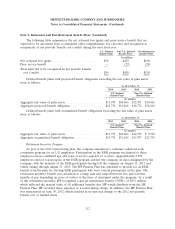

Note 4: Retirement and Post-Retirement Benefit Plans (Continued)

to the absence of quoted market prices, and these assets are generally classified in Level 2 of the fair

value hierarchy. Cash and cash equivalents includes money market funds, which are valued based on

NAV. Other assets, including insurance group annuity contracts, were classified in the fair value

hierarchy based on the lowest level input (e.g., quoted prices and observable inputs) that is significant

to the fair value measure in its entirety.

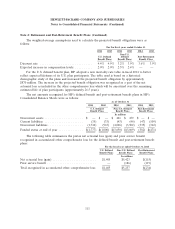

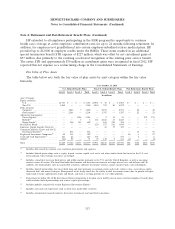

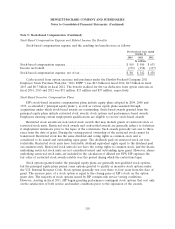

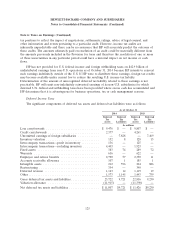

Plan Asset Allocations

The weighted-average target and actual asset allocations across the benefit plans at the respective

measurement dates were as follows:

Non-U.S. Defined Post-Retirement

U.S. Defined Benefit Plans Benefit Plans Benefit Plans

2014 2014 2014

Plan Assets Plan Assets Plan Assets

Target Target Target

Asset Category Allocation 2014 2013 Allocation 2014 2013 Allocation 2014 2013

Public equity securities ..... 31.3% 36.7% 46.8% 48.0% 10.2% 9.5%

Private/other equity securities . 15.8% 12.6% 15.2% 7.9% 58.6% 59.1%

Real estate and other ...... 0.6% — 7.1% 7.5% — —

Equity-related investments . . . 47.5% 47.7% 49.3% 67.7% 69.1% 63.4% 71.1% 68.8% 68.6%

Debt securities ........... 52.5% 49.2% 48.2% 31.6% 27.6% 32.5% 27.0% 27.5% 29.0%

Cash .................. — 3.1% 2.5% 0.7% 3.3% 4.1% 1.9% 3.7% 2.4%

Total ................ 100.0% 100.0% 100.0% 100.0% 100.0% 100.0% 100.0% 100.0% 100.0%

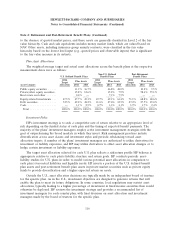

Investment Policy

HP’s investment strategy is to seek a competitive rate of return relative to an appropriate level of

risk depending on the funded status of each plan and the timing of expected benefit payments. The

majority of the plans’ investment managers employ active investment management strategies with the

goal of outperforming the broad markets in which they invest. Risk management practices include

diversification across asset classes and investment styles and periodic rebalancing toward asset

allocation targets. A number of the plans’ investment managers are authorized to utilize derivatives for

investment or liability exposures, and HP may utilize derivatives to effect asset allocation changes or to

hedge certain investment or liability exposures.

The target asset allocation selected for each U.S. plan reflects a risk/return profile HP believes is

appropriate relative to each plan’s liability structure and return goals. HP conducts periodic asset-

liability studies for U.S. plans in order to model various potential asset allocations in comparison to

each plan’s forecasted liabilities and liquidity needs. HP invests a portion of the U.S. defined benefit

plan assets and post-retirement benefit plan assets in private market securities such as private equity

funds to provide diversification and a higher expected return on assets.

Outside the U.S., asset allocation decisions are typically made by an independent board of trustees

for the specific plan. As in the U.S., investment objectives are designed to generate returns that will

enable the plan to meet its future obligations. In some countries, local regulations may restrict asset

allocations, typically leading to a higher percentage of investment in fixed income securities than would

otherwise be deployed. HP reviews the investment strategy and provides a recommended list of

investment managers for each country plan, with final decisions on asset allocation and investment

managers made by the board of trustees for the specific plan.

116