HP 2014 Annual Report Download - page 59

Download and view the complete annual report

Please find page 59 of the 2014 HP annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.HEWLETT-PACKARD COMPANY AND SUBSIDIARIES

Management’s Discussion and Analysis of

Financial Condition and Results of Operations (Continued)

Our effective tax rate includes the impact of certain undistributed foreign earnings for which we

have not provided U.S. federal taxes because we plan to reinvest such earnings indefinitely outside the

U.S. We plan distributions of foreign earnings based on projected cash flow needs as well as the

working capital and long-term investment requirements of our foreign subsidiaries and our domestic

operations. Based on these assumptions, we estimate the amount we expect to indefinitely invest

outside the U.S. and the amounts we expect to distribute to the U.S. and provide the U.S. federal taxes

due on amounts expected to be distributed to the U.S. Further, as a result of certain employment

actions and capital investments we have undertaken, income from manufacturing activities in certain

jurisdictions is subject to reduced tax rates and, in some cases, is wholly exempt from taxes for fiscal

years through 2024. Material changes in our estimates of cash, working capital and long-term

investment requirements in the various jurisdictions in which we do business could impact how future

earnings are repatriated to the U.S., and our related future effective tax rate.

We are subject to income taxes in the U.S. and approximately 105 other countries, and we are

subject to routine corporate income tax audits in many of these jurisdictions. We believe that positions

taken on our tax returns are fully supported, but tax authorities may challenge these positions, which

may not be fully sustained on examination by the relevant tax authorities. Accordingly, our income tax

provision includes amounts intended to satisfy assessments that may result from these challenges.

Determining the income tax provision for these potential assessments and recording the related effects

requires management judgments and estimates. The amounts ultimately paid on resolution of an audit

could be materially different from the amounts previously included in our income tax provision and,

therefore, could have a material impact on our income tax provision, net income and cash flows. Our

accrual for uncertain tax positions is attributable primarily to uncertainties concerning the tax treatment

of our international operations, including the allocation of income among different jurisdictions,

intercompany transactions and related interest. For a further discussion on taxes on earnings, refer to

Note 6 to the Consolidated Financial Statements in Item 8, which is incorporated herein by reference.

Inventory

We state our inventory at the lower of cost or market on a first-in, first-out basis. We make

adjustments to reduce the cost of inventory to its net realizable value at the product group level for

estimated excess, obsolescence or impaired balances. Factors influencing these adjustments include

changes in demand, technological changes, product life cycle and development plans, component cost

trends, product pricing, physical deterioration and quality issues.

Goodwill

We review goodwill for impairment annually and whenever events or changes in circumstances

indicate the carrying amount of goodwill may not be recoverable. While we are permitted to conduct a

qualitative assessment to determine whether it is necessary to perform a two-step quantitative goodwill

impairment test, for our annual goodwill impairment test in the fourth quarter of fiscal 2014, we

performed a quantitative test for all of our reporting units.

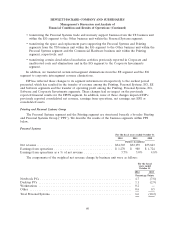

Goodwill is tested for impairment at the reporting unit level. At the beginning of the first quarter

of fiscal 2014, we changed our reporting units. In connection with continued operational synergies and

interdependencies between the Enterprise Servers, Storage and Networking reporting unit and the TS

reporting unit within the EG segment, we combined these reporting units to create the EG reporting

unit. As of October 31, 2014, our reporting units are consistent with the reportable segments identified

51