HP 2014 Annual Report Download - page 123

Download and view the complete annual report

Please find page 123 of the 2014 HP annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

HEWLETT-PACKARD COMPANY AND SUBSIDIARIES

Notes to Consolidated Financial Statements (Continued)

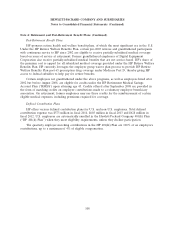

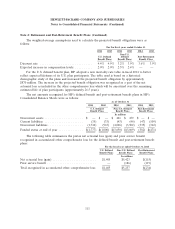

Note 4: Retirement and Post-Retirement Benefit Plans (Continued)

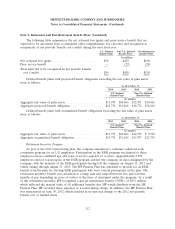

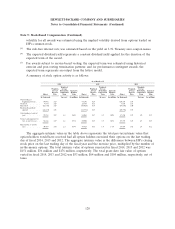

(3) Includes a fund that invests in both private and public equities primarily in the U.S. and the United Kingdom, as well as emerging

markets across all sectors. The fund also holds fixed income and derivative instruments to hedge interest rate and inflation risk. In

addition, the fund includes units in transferable securities, collective investment schemes, money market funds, cash and deposits.

(4) Includes limited partnerships that invest both long and short primarily in common stocks and credit, relative value, event driven

equity, distressed debt and macro strategies. Management of the hedge funds has the ability to shift investments from value to

growth strategies, from small to large capitalization stocks and bonds, and from a net long position to a net short position.

(5) Department of Labor 103-12 IE (Investment Entity) designation is for plan assets held by two or more unrelated employee benefit

plans which includes limited partnerships and venture capital partnerships.

(6) Includes publicly and privately traded Registered Investment Entities.

(7) Includes cash and cash equivalents such as short-term marketable securities.

(8) Includes international insured contracts, derivative instruments and unsettled transactions.

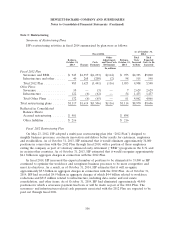

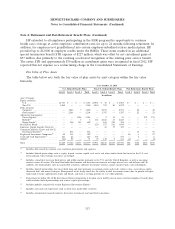

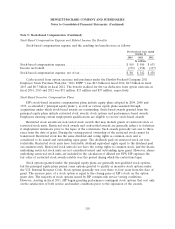

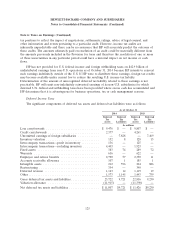

Changes in fair value measurements of Level 3 investments were as follows:

For the fiscal year ended October 31, 2013

Post-Retirement

U.S. Defined Benefit Plans Non-U.S. Defined Benefit Plans Benefit Plans

Debt Alternative Alternative Alternative

Securities Investments Equity Investments Investments

Insurance

Corporate Private Hedge Non U.S. Private Hedge Real Group Private

Debt Equity Hybrids Funds Total Equities Equity Funds Estate Annuities Other Total Equity Hybrids Total

In millions

Beginning balance at

October 31, 2012 ...... $1 $1,300 $ 2 $ 65 $1,368 $76 $21 $233 $194 $88 $ 2 $614 $235 $ 1 $236

Actual return on plan assets:

Relating to assets still held

at the reporting date . . — (9) — 13 4 1 8 — 16 (5) — 20 5 — 5

Relating to assets sold

during the period . . . . — 143 — — 143 — — 11 — — — 11 21 — 21

Purchases, sales, and

settlements (net) ...... — (184) — 35 (149) — 19 (40) 115 (2) — 92 (27) — (27)

Transfers in and/or out of

Level 3 ........... (1) — — — (1) — — — — — — — — — —

Ending balance at

October 31, 2013 ...... $— $1,250 $ 2 $113 $1,365 $77 $48 $204 $325 $81 $ 2 $737 $234 $ 1 $235

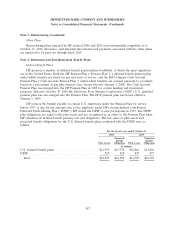

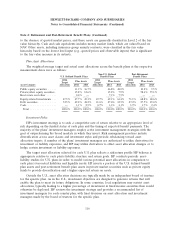

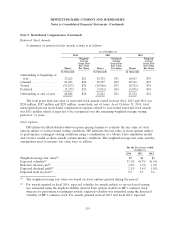

The following is a description of the valuation methodologies used to measure plan assets at fair

value. There have been no changes in the methodologies used during the reporting period.

Investments in publicly-traded equity securities are valued using the closing price on the

measurement date as reported on the stock exchange on which the individual securities are traded. For

corporate, government and asset-backed debt securities, fair value is based on observable inputs of

comparable market transactions. For corporate and government debt securities traded on active

exchanges, fair value is based on observable quoted prices. The valuation of alternative investments,

such as limited partnerships and joint ventures, may require significant management judgment. For

alternative investments, valuation is based on net asset value (‘‘NAV’’) as reported by the Asset

Manager and adjusted for cash flows, if necessary. In making such an assessment, a variety of factors

are reviewed by management, including, but not limited to, the timeliness of NAV as reported by the

asset manager and changes in general economic and market conditions subsequent to the last NAV

reported by the asset manager. Depending on the amount of management judgment, the lack of

near-term liquidity, and the absence of quoted market prices, these assets are classified in Level 2 or

Level 3 of the fair value hierarchy. Further, depending on how quickly HP can redeem its hedge fund

investments, and the extent of any adjustments to NAV, hedge funds are classified in either Level 2 or

Level 3 of the fair value hierarchy. Common collective trusts, interests in 103-12 entities and registered

investment companies are valued at NAV. The valuation for some of these assets requires judgment due

115