HP 2014 Annual Report Download - page 67

Download and view the complete annual report

Please find page 67 of the 2014 HP annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.HEWLETT-PACKARD COMPANY AND SUBSIDIARIES

Management’s Discussion and Analysis of

Financial Condition and Results of Operations (Continued)

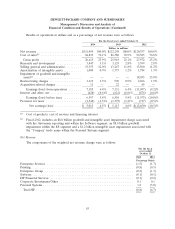

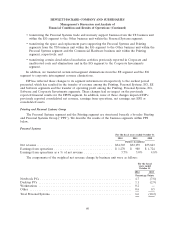

Restructuring Charges

Restructuring charges increased in fiscal 2014 due primarily to higher charges in connection with

the multi-year restructuring plan initially announced in May 2012 (the ‘‘2012 Plan’’) and from increases

to the 2012 Plan announced in fiscal 2014. During fiscal 2014, HP increased the total for positions

expected to be eliminated under the 2012 Plan from 34,000 to 55,000 positions. With these changes, HP

expects to recognize additional restructuring charges in fiscal 2015.

Restructuring charges decreased in fiscal 2013 due primarily to the $2.1 billion charge recorded in

fiscal 2012 for the 2012 Plan. Restructuring charges for fiscal 2013 were approximately $1.0 billion,

which included $1.2 billion of charges related to the 2012 Plan that were partially offset by a reversal of

$190 million of severance charges related to our fiscal 2010 ES restructuring plan.

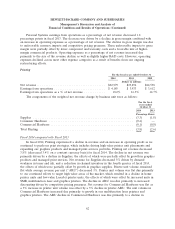

Interest and Other, Net

Interest and other, net expense increased by $7 million in fiscal 2014. The increase was due

primarily to higher currency transaction losses partially offset by lower interest expense from a lower

average debt balance.

Interest and other, net expense decreased by $255 million in fiscal 2013. The decrease was driven

primarily by lower currency transaction losses coupled with lower interest expense due to lower average

debt balances and lower investment losses.

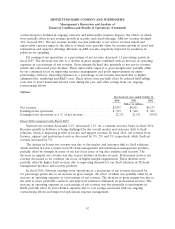

Provision for Taxes

Our effective tax rates were 23.5%, 21.5%, and (6.0)% in fiscal 2014, 2013 and 2012, respectively.

Our effective tax rate generally differs from the U.S. federal statutory rate of 35% due to favorable tax

rates associated with certain earnings from our operations in lower-tax jurisdictions throughout the

world. The jurisdictions with favorable tax rates that had the most significant effective tax rate impact

in the periods presented were Puerto Rico, Singapore, Netherlands, China and Ireland. We plan to

reinvest certain earnings of these jurisdictions indefinitely outside the U.S. and therefore have not

provided U.S. taxes on those indefinitely reinvested earnings.

In addition to the above factors, the effective tax rate in fiscal 2012 was impacted by nondeductible

goodwill impairments and increases in valuation allowances against certain deferred tax assets.

For a reconciliation of our effective tax rate to the U.S. federal statutory rate of 35% and further

explanation of our provision for taxes, see Note 6 to the Consolidated Financial Statements in Item 8,

which is incorporated herein by reference.

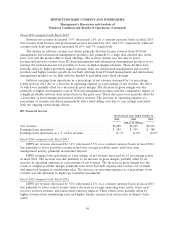

Segment Information

A description of the products and services for each segment can be found in Note 2 to the

Consolidated Financial Statements in Item 8, which is incorporated herein by reference. Future changes

to this organizational structure may result in changes to the segments disclosed.

Effective at the beginning of the first quarter of fiscal 2014, we implemented certain organizational

changes to align the segment financial reporting more closely with our current business structure. These

organizational changes include:

• transferring the HP Exstream business from the Commercial Hardware business unit within the

Printing segment to the Software segment;

59