HP 2014 Annual Report Download - page 65

Download and view the complete annual report

Please find page 65 of the 2014 HP annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

HEWLETT-PACKARD COMPANY AND SUBSIDIARIES

Management’s Discussion and Analysis of

Financial Condition and Results of Operations (Continued)

• HPFS net revenue decreased due primarily to lower rental revenue from a decrease in operating

lease assets; and

• Software net revenue declined due to lower license and professional services revenues from IT/

cloud management and information management products.

A more detailed discussion of segment revenue is included under ‘‘Segment Information’’ below.

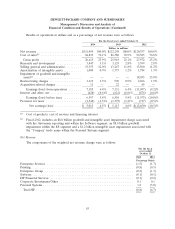

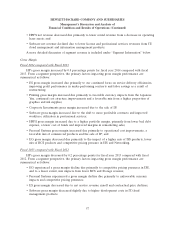

Gross Margin

Fiscal 2014 compared with Fiscal 2013

HP’s gross margin increased by 0.8 percentage points for fiscal year 2014 compared with fiscal

2013. From a segment perspective, the primary factors impacting gross margin performance are

summarized as follows:

• ES gross margin increased due primarily to our continued focus on service delivery efficiencies,

improving profit performance in under-performing contracts and labor savings as a result of

restructuring;

• Printing gross margin increased due primarily to favorable currency impacts from the Japanese

Yen, continued cost structure improvements and a favorable mix from a higher proportion of

graphics and ink supplies;

• Corporate Investments gross margin increased due to the sale of IP;

• Software gross margin increased due to the shift to more profitable contracts and improved

workforce utilization in professional services;

• HPFS gross margin increased due to a higher portfolio margin, primarily from lower bad debt

expense, a lower cost of funds and improved margins in remarketing sales;

• Personal Systems gross margin increased due primarily to operational cost improvements, a

favorable mix of commercial products and the sale of IP; and

• EG gross margin decreased due primarily to the impact of a higher mix of ISS products, lower

mix of BCS products and competitive pricing pressure in ISS and Networking.

Fiscal 2013 compared with Fiscal 2012

HP’s gross margin decreased by 0.2 percentage points for fiscal year 2013 compared with fiscal

2012. From a segment perspective, the primary factors impacting gross margin performance are

summarized as follows:

• EG experienced a gross margin decline due primarily to competitive pricing pressures in ISS,

and to a lesser extent, mix impacts from lower BCS and Storage revenue;

• Personal Systems experienced a gross margin decline due primarily to unfavorable currency

impacts and competitive pricing pressures;

• ES gross margin decreased due to net service revenue runoff and contractual price declines;

• Software gross margin decreased slightly due to higher development costs in IT/cloud

management products;

57