HP 2014 Annual Report Download - page 80

Download and view the complete annual report

Please find page 80 of the 2014 HP annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

HEWLETT-PACKARD COMPANY AND SUBSIDIARIES

Management’s Discussion and Analysis of

Financial Condition and Results of Operations (Continued)

Amounts held outside of the U.S. are generally utilized to support non-U.S. liquidity needs,

although a portion of those amounts may from time to time be subject to short-term intercompany

loans into the U.S. Most of the amounts held outside of the U.S. could be repatriated to the U.S. but,

under current law, some would be subject to U.S. federal income taxes, less applicable foreign tax

credits. Repatriation of some foreign earnings is restricted by local law. Except for foreign earnings that

are considered indefinitely reinvested outside of the U.S., we have provided for the U.S. federal tax

liability on these earnings for financial statement purposes. Repatriation could result in additional

income tax payments in future years. Where local restrictions prevent an efficient intercompany transfer

of funds, our intent is that cash balances would remain outside of the U.S. and we would meet liquidity

needs through ongoing cash flows, external borrowings, or both. We do not expect restrictions or

potential taxes incurred on repatriation of amounts held outside of the U.S. to have a material effect

on our overall liquidity, financial condition or results of operations.

Liquidity

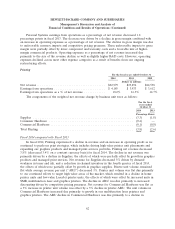

Our cash and cash equivalents, total debt and available borrowing resources were as follows:

As of October 31

2014 2013 2012

In billions

Cash and cash equivalents ....................................... $15.1 $12.2 $11.3

Total debt ................................................... $19.5 $22.6 $28.4

Available borrowing resources(1) ................................... $17.8 $17.8 $17.4

(1) In addition to these available borrowing resources, we are able to offer for sale, from time to time,

in one or more offerings, an unspecified amount of debt securities, common stock, preferred stock,

depositary shares and warrants under a shelf registration statement filed with the Securities and

Exchange Commission in May 2012 (the ‘‘2012 Shelf Registration Statement’’).

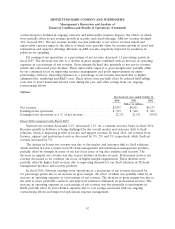

Our key cash flow metrics were as follows:

For the fiscal years ended

October 31

2014 2013 2012

In millions

Net cash provided by operating activities ........................ $12,333 $11,608 $10,571

Net cash used in investing activities ............................ (2,792) (2,803) (3,453)

Net cash used in financing activities ........................... (6,571) (7,943) (3,860)

Net increase in cash and cash equivalents ...................... $ 2,970 $ 862 $ 3,258

Operating Activities

Net cash provided by operating activities increased by $0.7 billion for fiscal 2014 as compared to

fiscal 2013, due primarily to improvements in working capital management. Net cash provided by

operating activities increased by $1.0 billion for fiscal 2013 compared to fiscal 2012, due primarily to

improvements in working capital management and a reduction in payments associated with webOS

contract cancellations.

72