HP 2014 Annual Report Download - page 66

Download and view the complete annual report

Please find page 66 of the 2014 HP annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.HEWLETT-PACKARD COMPANY AND SUBSIDIARIES

Management’s Discussion and Analysis of

Financial Condition and Results of Operations (Continued)

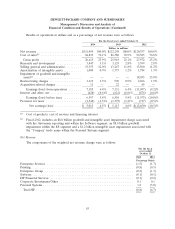

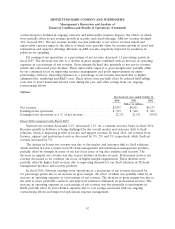

• HPFS gross margin increased slightly due primarily to higher portfolio margins from a lower mix

of operating leases and higher margins on early buyouts; and

• Printing gross margin increased due primarily to improvement in toner gross margins as a result

of lower discounting and higher average revenue per unit (‘‘ARU’’) in consumer printers.

A more detailed discussion of segment gross margins and operating margins is included under

‘‘Segment Information’’ below.

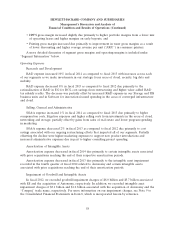

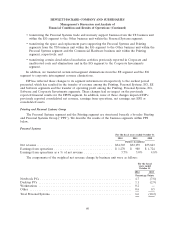

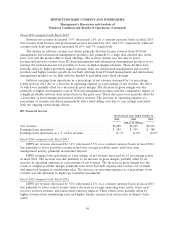

Operating Expenses

Research and Development

R&D expense increased 10% in fiscal 2014 as compared to fiscal 2013 with increases across each

of our segments as we make investments in our strategic focus areas of cloud, security, big data and

mobility.

R&D expense decreased 8% in fiscal 2013 as compared to fiscal 2012 due primarily to the

rationalization of R&D in EG for BCS, cost savings from restructuring and higher value added R&D

tax subsidy credits. The decrease was partially offset by increased R&D expense in our Storage and ISS

business units and in Software for innovation-focused spending in the areas of converged infrastructure

and cloud.

Selling, General and Administrative

SG&A expense increased 1% in fiscal 2014 as compared to fiscal 2013 due primarily to higher

compensation costs, litigation expenses and higher selling costs from investments in the areas of cloud,

networking and storage, partially offset by gains from sales of real estate and lower program spending

in marketing.

SG&A expense decreased 2% in fiscal 2013 as compared to fiscal 2012 due primarily to cost

savings associated with our ongoing restructuring efforts that impacted all of our segments. Partially

offsetting the decline were higher marketing expenses to support new product introductions and

increased administrative expenses due in part to higher consulting project spending.

Amortization of Intangible Assets

Amortization expense decreased in fiscal 2014 due primarily to certain intangible assets associated

with prior acquisitions reaching the end of their respective amortization periods.

Amortization expense decreased in fiscal 2013 due primarily to the intangible asset impairment

recorded in the fourth quarter of fiscal 2012 related to Autonomy and certain intangible assets

associated with prior acquisitions reaching the end of their amortization periods.

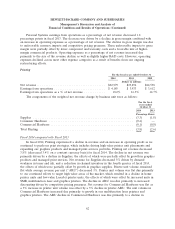

Impairment of Goodwill and Intangible Assets

In fiscal 2012, we recorded goodwill impairment charges of $8.0 billion and $5.7 billion associated

with ES and the acquisition of Autonomy, respectively. In addition, we recorded intangible asset

impairment charges of $3.1 billion and $1.2 billion associated with the acquisition of Autonomy and the

‘‘Compaq’’ trade name, respectively. For more information on our impairment charges, see Note 9 to

the Consolidated Financial Statements in Item 8, which is incorporated herein by reference.

58