HP 2014 Annual Report Download - page 133

Download and view the complete annual report

Please find page 133 of the 2014 HP annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

HEWLETT-PACKARD COMPANY AND SUBSIDIARIES

Notes to Consolidated Financial Statements (Continued)

Note 6: Taxes on Earnings (Continued)

tax positions to reflect the impact of negotiations, settlements, rulings, advice of legal counsel, and

other information and events pertaining to a particular audit. However, income tax audits are

inherently unpredictable and there can be no assurance that HP will accurately predict the outcome of

these audits. The amounts ultimately paid on resolution of an audit could be materially different from

the amounts previously included in the Provision for taxes and therefore the resolution of one or more

of these uncertainties in any particular period could have a material impact on net income or cash

flows.

HP has not provided for U.S. federal income and foreign withholding taxes on $42.9 billion of

undistributed earnings from non-U.S. operations as of October 31, 2014 because HP intends to reinvest

such earnings indefinitely outside of the U.S. If HP were to distribute these earnings, foreign tax credits

may become available under current law to reduce the resulting U.S. income tax liability.

Determination of the amount of unrecognized deferred tax liability related to these earnings is not

practicable. HP will remit non-indefinitely reinvested earnings of its non-U.S. subsidiaries for which

deferred U.S. federal and withholding taxes have been provided where excess cash has accumulated and

HP determines that it is advantageous for business operations, tax or cash management reasons.

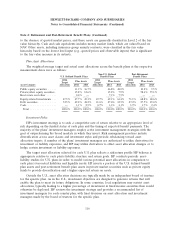

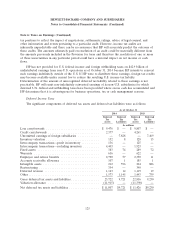

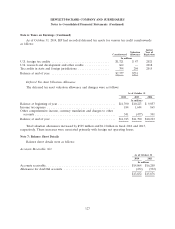

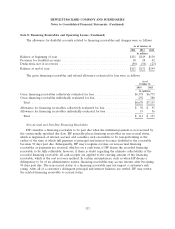

Deferred Income Taxes

The significant components of deferred tax assets and deferred tax liabilities were as follows:

As of October 31

2014 2013

Deferred Deferred Deferred Deferred

Tax Ta x Tax Tax

Assets Liabilities Assets Liabilities

In millions

Loss carryforwards .............................. $ 9,476 $ — $ 9,807 $ —

Credit carryforwards ............................. 2,377 — 4,261 —

Unremitted earnings of foreign subsidiaries ............ — 7,828 — 7,469

Inventory valuation .............................. 152 8 128 13

Intercompany transactions—profit in inventory .......... 136 — 125 —

Intercompany transactions—excluding inventory ......... 4,403 — 1,923 —

Fixed assets ................................... 383 74 289 72

Warranty ..................................... 616 — 622 —

Employee and retiree benefits ...................... 2,790 57 2,350 11

Accounts receivable allowance ...................... 107 1 185 1

Intangible assets ................................ 212 596 224 886

Restructuring .................................. 354 — 340 —

Deferred revenue ............................... 1,143 12 1,119 19

Other ........................................ 1,573 1,145 1,443 759

Gross deferred tax assets and liabilities ................ 23,722 9,721 22,816 9,230

Valuation allowance ............................. (11,915) — (11,390) —

Net deferred tax assets and liabilities ................. $11,807 $9,721 $ 11,426 $9,230

125