HP 2014 Annual Report Download - page 140

Download and view the complete annual report

Please find page 140 of the 2014 HP annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

HEWLETT-PACKARD COMPANY AND SUBSIDIARIES

Notes to Consolidated Financial Statements (Continued)

Note 8: Financing Receivables and Operating Leases (Continued)

Credit Quality Indicators

Due to the homogenous nature of its leasing transactions, HP manages its financing receivables on

an aggregate basis when assessing and monitoring credit risk. Credit risk is generally diversified due to

the large number of entities comprising HP’s customer base and their dispersion across many different

industries and geographic regions. HP evaluates the credit quality of an obligor at lease inception and

monitors that credit quality over the term of a transaction. HP assigns risk ratings to each lease based

on the creditworthiness of the obligor and other variables that augment or mitigate the inherent credit

risk of a particular transaction. Such variables include the underlying value and liquidity of the

collateral, the essential use of the equipment, the term of the lease, and the inclusion of credit

enhancements, such as guarantees, letters of credit or security deposits.

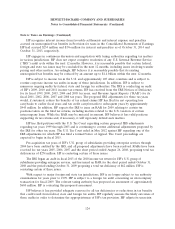

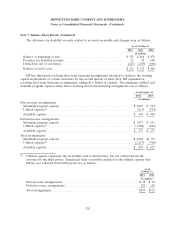

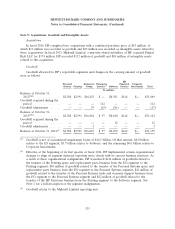

The credit risk profile of gross financing receivables, based on internally assigned ratings, was as

follows:

As of October 31

2014 2013

In millions

Risk Rating:

Low ........................................................... $3,536 $3,948

Moderate ........................................................ 3,022 3,084

High ........................................................... 112 121

Total ........................................................... $6,670 $7,153

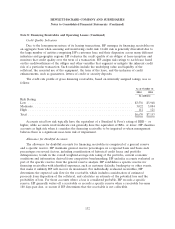

Accounts rated low risk typically have the equivalent of a Standard & Poor’s rating of BBBǁ or

higher, while accounts rated moderate risk generally have the equivalent of BB+ or lower. HP classifies

accounts as high risk when it considers the financing receivable to be impaired or when management

believes there is a significant near-term risk of impairment.

Allowance for Doubtful Accounts

The allowance for doubtful accounts for financing receivables is comprised of a general reserve

and a specific reserve. HP maintains general reserve percentages on a regional basis and bases such

percentages on several factors, including consideration of historical credit losses and portfolio

delinquencies, trends in the overall weighted-average risk rating of the portfolio, current economic

conditions and information derived from competitive benchmarking. HP excludes accounts evaluated as

part of the specific reserve from the general reserve analysis. HP establishes a specific reserve for

financing receivables with identified exposures, such as customer defaults, bankruptcy or other events,

that make it unlikely HP will recover its investment. For individually evaluated receivables, HP

determines the expected cash flow for the receivable, which includes consideration of estimated

proceeds from disposition of the collateral, and calculates an estimate of the potential loss and the

probability of loss. For those accounts where a loss is considered probable, HP records a specific

reserve. HP generally writes off a receivable or records a specific reserve when a receivable becomes

180 days past due, or sooner if HP determines that the receivable is not collectible.

132