HP 2014 Annual Report Download - page 176

Download and view the complete annual report

Please find page 176 of the 2014 HP annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

HEWLETT-PACKARD COMPANY AND SUBSIDIARIES

Notes to Consolidated Financial Statements (Continued)

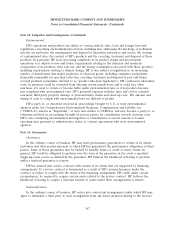

Note 16: Guarantees (Continued)

they perform on behalf of HP or for losses arising from certain events as defined within the particular

contract, which may include, for example, litigation or claims relating to past performance. HP also

provides indemnifications to certain vendors and customers against claims of IP infringement made by

third parties arising from the vendor’s and customer’s use of HP’s software products and services and

certain other matters. Some indemnifications may not be subject to maximum loss clauses. Historically,

payments made related to these indemnifications have been immaterial.

Warranty

HP accrues the estimated cost of product warranties at the time it recognizes revenue. HP engages

in extensive product quality programs and processes, including actively monitoring and evaluating the

quality of its component suppliers; however, contractual warranty terms, repair costs, product call rates,

average cost per call, current period product shipments and ongoing product failure rates, as well as

specific product class failures outside of HP’s baseline experience, affect the estimated warranty

obligation.

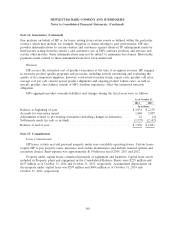

HP’s aggregate product warranty liabilities and changes during the fiscal years were as follows:

As of October 31

2014 2013

In millions

Balance at beginning of year ........................................ $2,031 $ 2,170

Accruals for warranties issued ........................................ 1,840 2,007

Adjustments related to pre-existing warranties (including changes in estimates) .... 12 (4)

Settlements made (in cash or in kind) .................................. (1,927) (2,142)

Balance at end of year ............................................. $1,956 $ 2,031

Note 17: Commitments

Lease Commitments

HP leases certain real and personal property under non-cancelable operating leases. Certain leases

require HP to pay property taxes, insurance and routine maintenance and include renewal options and

escalation clauses. Rent expense was approximately $1.0 billion in fiscal 2014, 2013 and 2012.

Property under capital leases comprised primarily of equipment and furniture. Capital lease assets

included in Property, plant and equipment in the Consolidated Balance Sheets were $229 million and

$437 million as of October 31, 2014 and October 31, 2013, respectively. Accumulated depreciation on

the property under capital lease was $207 million and $404 million as of October 31, 2014 and

October 31, 2013, respectively.

168