HP 2014 Annual Report Download - page 147

Download and view the complete annual report

Please find page 147 of the 2014 HP annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

HEWLETT-PACKARD COMPANY AND SUBSIDIARIES

Notes to Consolidated Financial Statements (Continued)

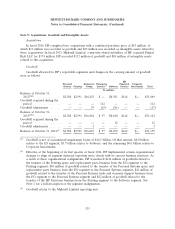

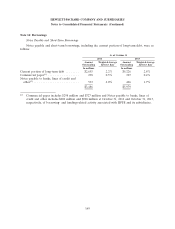

Note 9: Acquisitions, Goodwill and Intangible Assets (Continued)

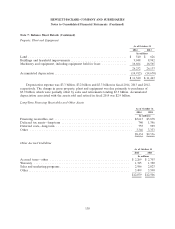

The weighted-average useful lives of intangible assets are as follows:

As of

October 31, 2014

Weighted-Average

Finite-Lived Intangible Assets Useful Lives

In years

Customer contracts, customer lists and distribution agreements .................. 8

Developed and core technology and patents ................................ 8

Trade name and trade marks ........................................... 7

As of October 31, 2014, estimated future amortization expense related to finite-lived intangible

assets was as follows:

Fiscal year In millions

2015 ................................................................ $ 872

2016 ................................................................ 653

2017 ................................................................ 244

2018 ................................................................ 147

2019 ................................................................ 110

Thereafter ............................................................ 102

Total ................................................................ $2,128

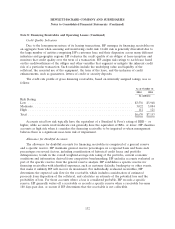

Note 10: Fair Value

Fair value is defined as the price that would be received to sell an asset or paid to transfer a

liability (an exit price) in an orderly transaction between market participants at the measurement date.

Fair Value Hierarchy

HP uses valuation techniques that are based upon observable and unobservable inputs. Observable

inputs are developed using market data such as publicly available information and reflect the

assumptions market participants would use, while unobservable inputs are developed using the best

information available about the assumptions market participants would use. Assets and liabilities are

classified in the fair value hierarchy based on the lowest level input that is significant to the fair value

measurement:

Level 1—Quoted prices (unadjusted) in active markets for identical assets or liabilities.

Level 2—Quoted prices for similar assets or liabilities in active markets, quoted prices for identical

or similar assets or liabilities in markets that are not active, inputs other than quoted prices that are

observable for the asset or liability and market-corroborated inputs.

Level 3—Unobservable inputs for the asset or liability.

The fair value hierarchy gives the highest priority to observable inputs and lowest priority to

unobservable inputs.

139