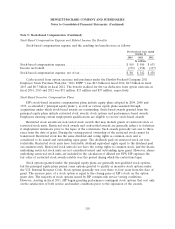

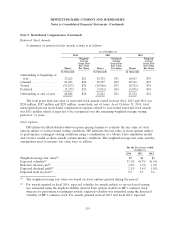

HP 2014 Annual Report Download - page 119

Download and view the complete annual report

Please find page 119 of the 2014 HP annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

HEWLETT-PACKARD COMPANY AND SUBSIDIARIES

Notes to Consolidated Financial Statements (Continued)

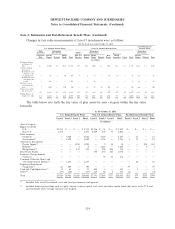

Note 4: Retirement and Post-Retirement Benefit Plans (Continued)

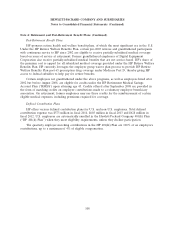

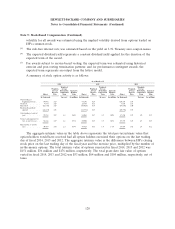

The weighted-average assumptions used to calculate the projected benefit obligations were as

follows:

For the fiscal years ended October 31

2014 2013 2014 2013 2014 2013

Non-U.S.

U.S. Defined Defined Post-Retirement

Benefit Plans Benefit Plans Benefit Plans

Discount rate .............................. 4.4% 4.9% 3.2% 3.9% 3.6% 3.9%

Expected increase in compensation levels .......... 2.0% 2.0% 2.5% 2.4% — —

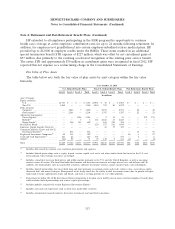

For the U.S. defined benefit plan, HP adopted a new mortality rate table in fiscal 2014 to better

reflect expected lifetimes of its U.S. plan participants. The table used is based on a historical

demographic study of the plans and increased the projected benefit obligation by approximately

$870 million. The increase in the projected benefit obligation was recognized as a part of the net

actuarial loss as included in the other comprehensive loss which will be amortized over the remaining

estimated life of plan participants (approximately 26.5 years).

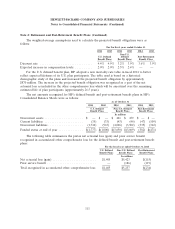

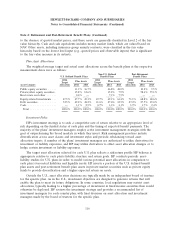

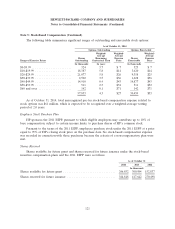

The net amounts recognized for HP’s defined benefit and post-retirement benefit plans in HP’s

Consolidated Balance Sheets were as follows:

As of October 31

2014 2013 2014 2013 2014 2013

U.S. Defined Non-U.S. Defined Post-Retirement

Benefit Plans Benefit Plans Benefit Plans

In millions

Noncurrent assets ...................... $ — $ — $ 421 $ 479 $ — $ —

Current liabilities ...................... (35) (33) (43) (46) (47) (109)

Noncurrent liabilities .................... (1,742) (967) (4,028) (3,502) (335) (362)

Funded status at end of year .............. $(1,777) $(1,000) $(3,650) $(3,069) (382) $(471)

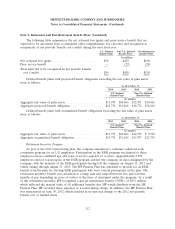

The following table summarizes the pretax net actuarial loss (gain) and prior service benefit

recognized in accumulated other comprehensive loss for the defined benefit and post-retirement benefit

plans:

For the fiscal year ended October 31, 2014

U.S. Defined Non-U.S. Defined Post-Retirement

Benefit Plans Benefit Plans Benefit Plans

In millions

Net actuarial loss (gain) ......................... $1,405 $5,423 $(115)

Prior service benefit ............................ — (186) (119)

Total recognized in accumulated other comprehensive loss $1,405 $5,237 $(234)

111