HP 2014 Annual Report Download - page 153

Download and view the complete annual report

Please find page 153 of the 2014 HP annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.HEWLETT-PACKARD COMPANY AND SUBSIDIARIES

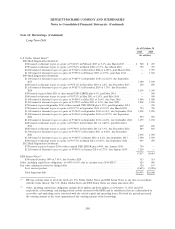

Notes to Consolidated Financial Statements (Continued)

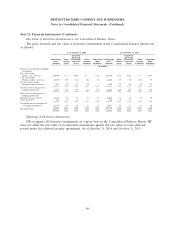

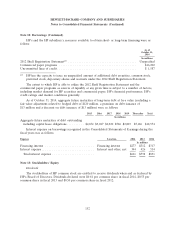

Note 11: Financial Instruments (Continued)

For derivative instruments that are designated and qualify as cash flow hedges, HP initially records

changes in fair value for the effective portion of the derivative instrument in Accumulated other

comprehensive loss as a separate component of stockholders’ equity in the Consolidated Balance Sheets

and subsequently reclassifies these amounts into earnings in the period during which the hedged

transaction is recognized in earnings. HP reports the effective portion of its cash flow hedges in the

same financial statement line item as changes in the fair value of the hedged item.

Net Investment Hedges

HP uses forward contracts designated as net investment hedges to hedge net investments in certain

foreign subsidiaries whose functional currency is the local currency. HP records the effective portion of

such derivative instruments together with changes in the fair value of the hedged items in Cumulative

translation adjustment as a separate component of stockholders’ equity in the Consolidated Balance

Sheets.

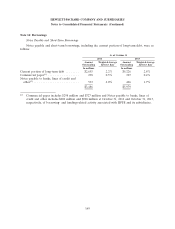

Other Derivatives

Other derivatives not designated as hedging instruments consist primarily of forward contracts used

to hedge foreign currency-denominated balance sheet exposures. HP also uses total return swaps and,

to a lesser extent, interest rate swaps, based on equity or fixed income indices, to hedge its executive

deferred compensation plan liability.

For derivative instruments not designated as hedging instruments, HP recognizes changes in fair

value of the derivative instrument, as well as the offsetting change in the fair value of the hedged item,

in Interest and other net in the Consolidated Statements of Earnings in the period of change.

Hedge Effectiveness

For interest rate swaps designated as fair value hedges, HP measures hedge effectiveness by

offsetting the change in fair value of the hedged instrument with the change in fair value of the

derivative. For foreign currency options and forward contracts designated as cash flow or net

investment hedges, HP measures hedge effectiveness by comparing the cumulative change in fair value

of the hedge contract with the cumulative change in fair value of the hedged item, both of which are

based on forward rates. HP recognizes any ineffective portion of the hedge in the Consolidated

Statements of Earnings in the same period in which ineffectiveness occurs. Amounts excluded from the

assessment of effectiveness are recognized in the Consolidated Statements of Earnings in the period

they arise.

145