HP 2014 Annual Report Download - page 52

Download and view the complete annual report

Please find page 52 of the 2014 HP annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

HEWLETT-PACKARD COMPANY AND SUBSIDIARIES

Management’s Discussion and Analysis of

Financial Condition and Results of Operations (Continued)

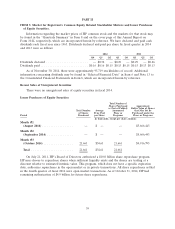

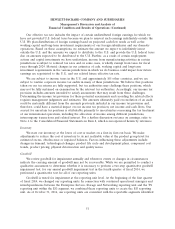

The following provides an overview of our key financial metrics by segment for fiscal 2014:

Printing and Personal

Systems Group

HP Personal Enterprise Enterprise Corporate

Consolidated Systems Printing Total Group Services Software HPFS Investments(2)

Dollars in millions, except per share amounts

Net revenue(1) . $111,454 $ 34,303 $22,979 $ 57,282 $ 27,814 $ 22,398 $ 3,933 $ 3,498 $ 302

Year-over-year

change % . . (0.8)% 6.6% (3.8)% 2.2% (1.0)% (6.9)% (2.2)% (3.6)% NM

Earnings from

operations(1) . $ 7,185 $ 1,270 $ 4,185 $ 5,455 $ 4,008 $ 803 $ 872 $ 389 $ (199)

Earnings from

operations

as a % of

net revenue 6.4% 3.7% 18.2% 9.5% 14.4% 3.6% 22.2% 11.1% NM

Year-over-year

change

percentage

points .... 0.0pts 0.7pts 1.7pts 0.7pts (0.8) pts 0.8pts 0.6pts 0.1pts NM

Net earnings . $ 5,013

Net earnings

per share

Basic .... $ 2.66

Diluted . . . $ 2.62

(1) HP consolidated net revenue excludes intersegment net revenue and other. Segment earnings from operations exclude corporate

and unallocated costs, stock-based compensation expense, amortization of intangible assets, restructuring charges and acquisition-

related charges.

(2) ‘‘NM’’ represents not meaningful.

HP net revenue declined 0.8% (decreased 0.4% on a constant currency basis) in fiscal 2014 as

compared to fiscal 2013. The leading contributors to the HP net revenue decline were key account

runoff in ES and lower Printing supplies volume. Partially offsetting the net revenue decline was growth

in Personal Systems from commercial personal computers (‘‘PCs’’), which experienced growth across all

product categories, along with growth in consumer notebooks. HP’s gross margin increased by

0.8 percentage points in fiscal 2014 due primarily to service delivery efficiencies and improvements in

underperforming contracts in ES and favorable currency impacts from the Japanese Yen and continued

cost structure improvements in Printing. We continue to experience gross margin pressures resulting

from a competitive pricing environment across our hardware portfolio. HP’s operating margin was flat

for fiscal 2014 as compared to fiscal 2013 due to the gross margin increase, improved business

performance primarily in Printing, ES and Personal Systems, and lower intangible asset amortization,

offset by higher restructuring charges, investments in research and development (‘‘R&D’’), and higher

selling, general and administrative (‘‘SG&A’’) expenses. The increase in SG&A expenses was partially

offset by gains from sales of real estate.

Our business continues to produce significant cash flow from operations, generating $12.3 billion in

fiscal 2014. Additionally, we invested $3.0 billion in property, plant and equipment net of proceeds

from sales, repurchased $2.7 billion of common stock and paid dividends of $1.2 billion to stockholders.

As of October 31, 2014, cash and cash equivalents and short- and long-term investments were

$15.5 billion, representing an increase of approximately $3.0 billion from October 31, 2013.

We continue to experience challenges that are representative of trends and uncertainties that may

affect our business and results of operations. One set of challenges relates to continuing dynamic and

accelerating market trends. Another set of challenges relates to changes in the competitive landscape.

Our major competitors are expanding their product and service offerings with integrated products and

44