Clearwire 2010 Annual Report Download - page 99

Download and view the complete annual report

Please find page 99 of the 2010 Clearwire annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

in the pricing models where quoted market prices from securities and derivatives exchanges are available and

reliable. We also use certain unobservable inputs that cannot be validated by reference to a readily observable

market or exchange data and rely, to a certain extent, on management’s own assumptions about the assumptions that

market participants would use in pricing the security. We use many factors that are necessary to estimate market

values, including interest rates, market risks, market spreads, timing of contractual cash flows, market liquidity,

review of underlying collateral and principal, interest and dividend payments.

Derivatives

Derivatives are classified in Level 3 of the valuation hierarchy. To estimate the fair value, we use an income

approach based on valuation models, including option pricing models and discounted cash flow models. We

maximize the use of market-based observable inputs in the models and develop our own assumptions for

unobservable inputs based on management estimates of market participants’ assumptions in pricing the

instruments.

We use a trinomial option pricing model to estimate the fair value of the Exchange Options. The inputs include

the contractual terms of the instrument and market-based parameters such as interest rate forward curves, stock

price and dividend yield. A level of subjectivity is applied to estimate our stock price volatility. The stock price

volatility is based on our historical stock price volatility giving consideration to our estimates of market participant

adjustments for general market conditions as well as company-specific factors such as market trading volume and

our expected future performance.

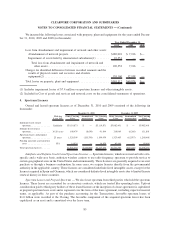

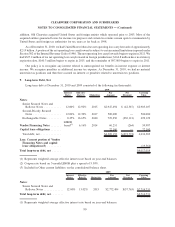

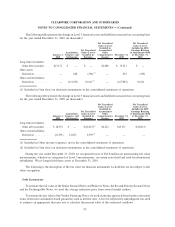

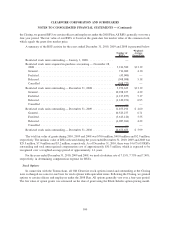

The following table summarizes our financial assets and liabilities by level within the valuation hierarchy at

December 31, 2010 (in thousands):

Quoted

Prices in

Active

Markets

(Level 1)

Significant

Other

Observable

Inputs

(Level 2)

Significant

Unobservable

Inputs

(Level 3)

Total

Fair Value

Financial assets:

Cash and cash equivalents ........... $1,233,562 $ — $ — $1,233,562

Short-term investments .............. $ 502,316 $ — $ — $ 502,316

Long-term investments .............. $ — $ — $ 15,251 $ 15,251

Other assets — derivative assets ....... $ — $ — $ 292 $ 292

Financial liabilities:

Other current liabilities — derivative

liabilities ...................... $ — $ — $(167,892) $ (167,892)

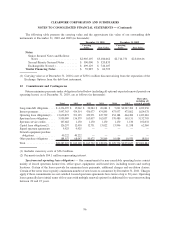

The following table summarizes our financial assets and liabilities by level within the valuation hierarchy at

December 31, 2009 (in thousands):

Quoted

Prices in

Active

Markets

(Level 1)

Significant

Other

Observable

Inputs

(Level 2)

Significant

Unobservable

Inputs

(Level 3)

Total

Fair Value

Financial assets:

Cash and cash equivalents ........... $1,698,017 $ — $ — $1,698,017

Short-term investments .............. $2,106,661 $ — $ — $2,106,661

Long-term investments .............. $ 74,516 $ — $13,171 $ 87,687

94

CLEARWIRE CORPORATION AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — (Continued)