Clearwire 2010 Annual Report Download - page 96

Download and view the complete annual report

Please find page 96 of the 2010 Clearwire annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Notes

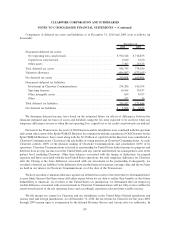

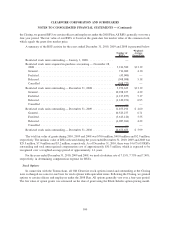

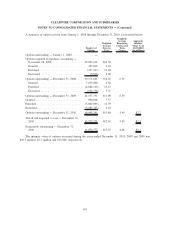

Senior Secured Notes and Rollover Notes — During the fourth quarter of 2009, Clearwire Communications

completed offerings of $2.52 billion 12% senior secured notes due 2015, which we refer to as the Senior Secured

Notes. We used $1.16 billion of the proceeds to retire indebtedness under the senior term loan facility that we

assumed from Old Clearwire and recognized a gain on extinguishment of debt of $8.3 million, net of transaction

costs. The Senior Secured Notes provide for bi-annual payments of interest in June and December. In connection

with the issuance of the Senior Secured Notes, we also issued $252.5 million of notes to Sprint and Comcast with

identical terms as the Senior Secured Notes, which we refer to as the Rollover Notes, in replacement of equal

amounts of indebtedness under the senior term loan facility.

During December 2010, Clearwire Communications issued an additional $175.0 million of Senior Secured

Notes with identical terms.

The holders of the Senior Secured Notes and Rollover Notes have the right to require us to repurchase all of the

notes upon the occurrence of a change of control event or a sale of certain assets, at a price of 101% of the principal

amount or 100% of the principal amount, respectively, plus any unpaid accrued interest to the repurchase date. Prior

to December 1, 2012, we may redeem up to 35% of the aggregate principal amount of the Senior Secured Notes at a

redemption price of 112% of the aggregate principal amount, plus any unpaid accrued interest to the repurchase

date. After December 1, 2012, we may redeem all or a part of the Senior Secured Notes by paying a make-whole

premium as stated in the terms, plus any unpaid accrued interest to the repurchase date.

Our payment obligations under the Senior Secured Notes and Rollover Notes are guaranteed by certain

domestic subsidiaries on a senior basis and secured by certain assets of such subsidiaries on a first-priority lien

basis. The Senior Secured Notes and Rollover Notes contain limitations on our activities, which among other things

include incurring additional indebtedness and guarantee indebtedness; making distributions or payment of

dividends or certain other restricted payments or investments; making certain payments on indebtedness; entering

into agreements that restrict distributions from restricted subsidiaries; selling or otherwise disposing of assets;

merger, consolidation or sales of substantially all of our assets; entering transactions with affiliates; creating liens;

issuing certain preferred stock or similar equity securities and making investments and acquiring assets.

Second-Priority Secured Notes — During December 2010, Clearwire Communications completed an offering

of $500 million 12% second-priority secured notes due 2017, which we refer to as the Second-Priority Secured

Notes. The Second-Priority Secured Notes provide for bi-annual payments of interest in June and December.

The holders of the Second-Priority Secured Notes have the right to require us to repurchase all of the notes

upon the occurrence of a change of control event or a sale of certain assets at a price of 101% of the principal amount

or 100% of the principal amount, respectively, plus any unpaid accrued interest to the repurchase date. Prior to

December 1, 2013, we may redeem up to 35% of the aggregate principal amount of the Second-Priority Secured

Notes at a redemption price of 112% of the aggregate principal amount, plus any unpaid accrued interest to the

repurchase date. After December 1, 2014, we may redeem all or a part of the Second-Priority Secured Notes by

paying a make-whole premium as stated in the terms, plus any unpaid accrued interest to the repurchase date.

Our payment obligations under the Second-Priority Secured Notes are guaranteed by certain domestic

subsidiaries on a senior basis and secured by certain assets of such subsidiaries on a second-priority lien basis.

The Second-Priority Secured Notes contain the same limitations on our activities as those of the Senior Secured

Notes and Rollover Notes.

Exchangeable Notes — During December 2010, Clearwire Communications completed offerings of

$729.2 million 8.25% exchangeable notes due 2040, which we refer to as the Exchangeable Notes. The

Exchangeable Notes provide for bi-annual payments of interest in June and December. The Exchangeable Notes

are subordinated to the Senior Secured Notes and Rollover Notes and rank equally in right of payment with the

Second-Priority Secured Notes.

91

CLEARWIRE CORPORATION AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — (Continued)