Clearwire 2010 Annual Report Download - page 107

Download and view the complete annual report

Please find page 107 of the 2010 Clearwire annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

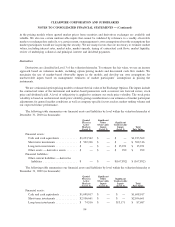

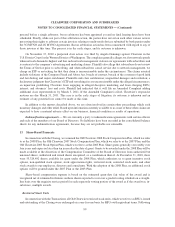

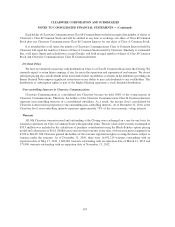

Information regarding stock options outstanding and exercisable as of December 31, 2010 is as follows:

Exercise Prices

Number of

Options

Weighted

Average

Contractual

Life

Remaining

(Years)

Weighted

Average

Exercise

Price

Number of

Options

Weighted

Average

Exercise

Price

Options Outstanding Options Exercisable

$2.25 — $3.00........................ 454,701 1.25 $ 2.86 454,701 $ 2.86

$3.03 ........................... 2,902,000 8.16 3.03 952,000 3.03

$3.53 — $5.45........................ 562,625 6.61 4.34 237,875 4.31

$6.00 ........................... 2,029,238 3.94 6.00 2,029,238 6.00

$6.07 — $7.66........................ 1,940,656 8.64 7.13 410,625 7.24

$7.87 — $15.00 ....................... 2,241,589 5.16 11.78 1,338,283 13.26

$16.02 .......................... 138,625 2.60 16.02 125,875 16.02

$17.11 .......................... 1,768,442 3.55 17.11 1,346,218 17.11

$18.00 — $20.16 ...................... 1,667,621 4.50 18.09 1,663,871 18.08

$23.30 — 25.33 ....................... 2,737,744 5.54 24.25 2,516,086 24.27

Total ......................... 16,443,241 5.69 $11.80 11,074,772 $13.93

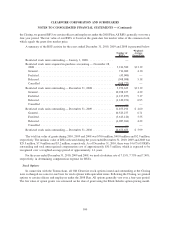

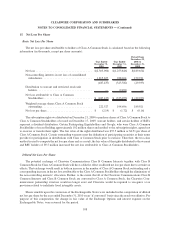

The fair value of each option grant is estimated on the date of grant using the Black-Scholes option pricing

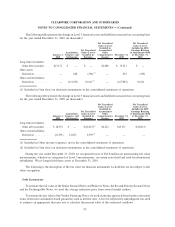

model using the following assumptions for the years ended December 31, 2010, 2009 and 2008:

2010 2009 2008

Year Ended December 31,

Expected volatility .......................... 58.80%-62.22% 63.35%-67.65% 66.52%

Expected dividend yield . . .................... — — —

Expected life (in years) . . .................... 6.25 4.75 - 6.25 4.75

Risk-free interest rate........................ 2.00%-3.15% 1.36% - 2.98% 1.93%

Weighted average fair value per option at grant

date ................................... $4.27 $2.63 $ 2.24

The fair value of option grants in 2010 and 2009 was $4.3 million and $18.6 million, respectively. In addition to

options issued in exchange as part of the Transactions, the fair value of option grants during 2008 was $954,000. The

total fair value of options vested during the years ended December 31, 2010, 2009 and 2008 was $9.8 million,

$5.8 million and $815,000, respectively. The total unrecognized share-based compensation costs related to non-

vested stock options outstanding at December 31, 2010 was approximately $5.8 million and is expected to be

recognized over a weighted average period of approximately 1.3 years.

For the years ended December 31, 2010, 2009 and 2008, we used a forfeiture rate of 10.09%, 12.66% and

12.66% respectively, in determining compensation expense for options.

102

CLEARWIRE CORPORATION AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — (Continued)