Clearwire 2010 Annual Report Download - page 41

Download and view the complete annual report

Please find page 41 of the 2010 Clearwire annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.• enter into transactions with affiliates;

• create or incur liens;

• merge, consolidate or sell substantially all of our assets;

• make investments and acquire assets;

• make certain payments on indebtedness; and

• issue certain preferred stock or similar equity securities.

A breach of the covenants or restrictions under the Indentures could result in a default under the applicable

indebtedness. Such default may allow the creditors to accelerate the related debt and may result in the acceleration

of any other debt to which a cross-acceleration or cross default provision applies. In the event our lenders and

noteholders accelerate the repayment of our borrowings, we cannot assure that we and our subsidiaries would have

sufficient assets to repay such indebtedness.

Our ability to obtain future financing or to sell assets could be adversely affected because a very large majority

of our assets have been pledged as collateral for the benefit of the holders of the Notes. In addition our financial

results, our substantial indebtedness and our credit ratings could adversely affect the availability and terms of

additional financing.

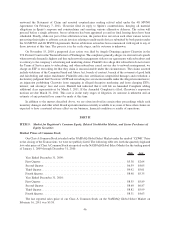

The market price of our Class A Common Stock has been and may continue to be volatile.

The trading price of our Class A Common Stock could be subject to significant fluctuations in price in response

to various factors, some of which are beyond our control. These factors include:

• quarterly variations in our results of operations or those of our competitors, either alone or in comparison to

analyst’s expectations;

• announcements by us or our competitors of acquisitions, new products or services,

• significant contracts, commercial relationships or capital commitments;

• the outcome of our dispute with Sprint regarding wholesale pricing issues, which could have a material

impact on the revenues we generate from our wholesale subscribers;

• announcements by us regarding the entering into, or termination of, material transactions;

• disruption to our operations or those of other companies critical to our network operations;

• the emergence of new competitors or new technologies;

• market perceptions relating to the deployment of 4G mobile networks by other operators;

• our ability to develop and market new and enhanced products on a timely basis;

• seasonal or other variations in our subscriber base;

• commencement of, or our involvement in, litigation;

• availability of additional spectrum;

• dilutive issuances of our stock or the equity of our subsidiaries, including on the exercise of outstanding

warrants and options, or the incurrence of additional debt;

• changes in our board or management;

• adoption of new accounting standards;

• Sprint’s performance may have an effect on the market price of our Class A Common Stock even though we

are a separate, stand-alone company;

• changes in governmental regulations or the status of our regulatory approvals;

36