Clearwire 2010 Annual Report Download - page 9

Download and view the complete annual report

Please find page 9 of the 2010 Clearwire annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Corporate Structure

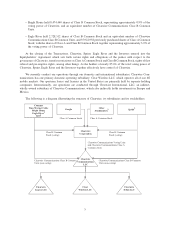

On November 28, 2008, Clearwire Corporation (f/k/a New Clearwire Corporation), which we refer to as

Clearwire or the Company, completed the transactions contemplated by the Transaction Agreement and Plan of

Merger dated as of May 7, 2008, as amended, which we refer to as the Transaction Agreement, with Clearwire

Legacy LLC (f/k/a Clearwire Corporation), which we refer to as Old Clearwire, Sprint, Comcast, Time Warner

Cable, Bright House Networks, LLC, which we refer to as Bright House, Google Inc., which we refer to as Google,

and Intel Corporation, which we refer to as Intel, and together with Comcast, Time Warner Cable, Bright House and

Google, the Investors. Under the Transaction Agreement, Old Clearwire was combined with Sprint’s mobile

WiMAX business, which we refer to as the Sprint WiMAX Business, and the Investors invested an aggregate of

$3.2 billion in the combined entity. We were formed on November 28, 2008, as a result of the closing of the

transactions, which we refer to as the Closing, under the Transaction Agreement, which we refer to as the

Transactions.

We currently have two classes of stock issued and outstanding, including our Class A common stock, par value

$0.0001 per share, which we refer to as Class A Common Stock, and our Class B common stock, par value $0.0001

per share, which we refer to as Class B Common Stock. Class B Common Stock has equal voting rights to our

Class A Common Stock, but has only limited economic rights. Unlike the holders of Class A Common Stock, the

holders of Class B Common Stock have no right to dividends and no right to any proceeds on liquidation other than

the par value of the Class B Common Stock.

Our operating subsidiary, Clearwire Communications LLC, a Delaware limited liability company which we

refer to as Clearwire Communications, also has two classes of non-voting equity interests outstanding, including

Class A units and Class B units, which we refer to as Clearwire Communications Class A Common Units and

Clearwire Communications Class B Common Units, respectively. Clearwire Communications has also issued a

class of voting units, which we refer to as Clearwire Communications Voting Units.

We hold all of the outstanding Clearwire Communications Class A Common Units, and all of the outstanding

Clearwire Communications Voting Units, representing an approximately 24.7% economic interest and 100% of the

voting power of Clearwire Communications as of December 31, 2010.

Sprint and the Investors, other than Google, own shares of our Class B Common Stock. Sprint and the Investors

other than Google hold the economic rights associated with their shares of Class B Common Stock through

ownership of Clearwire Communications Class B Common Units. Each share of Class B Common Stock plus one

Clearwire Communications Class B Common Unit is convertible into one share of Class A Common Stock. Google

and, to the extent of their holdings in Old Clearwire, Intel and Eagle River Holdings, LLC, which we refer to as

Eagle River, also hold shares of Class A Common Stock.

The ownership interests of Sprint, the Investors and Eagle River in Clearwire as of December 31, 2010 were as

follows:

• Sprint held 531,724,348 shares of Class B Common Stock, representing approximately 53.9% of the voting

power of Clearwire, and an equivalent number of Clearwire Communications Class B Common Units.

• Google held 29,411,765 shares of Class A Common Stock, representing approximately 3.0% of the voting

power of Clearwire.

• Intel held 65,644,812 shares of Class B Common Stock, an equivalent number of Clearwire Communi-

cations Class B Common Units, and 36,666,666 previously purchased shares of Class A Common Stock,

with the shares of Class A and Class B Common Stock together representing approximately 10.3% of the

voting power of Clearwire.

• Time Warner Cable held 46,404,782 shares of Class B Common Stock, representing approximately 4.7% of

the voting power of Clearwire, and an equivalent number of Clearwire Communications Class B Common

Units.

• Comcast held 88,504,132 shares of Class B Common Stock, representing approximately 8.9% of the voting

power of Clearwire, and an equivalent number of Clearwire Communications Class B Common Units.

4