Clearwire 2010 Annual Report Download - page 78

Download and view the complete annual report

Please find page 78 of the 2010 Clearwire annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

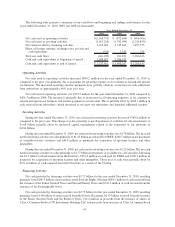

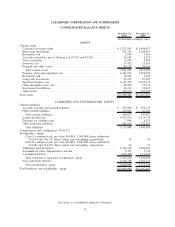

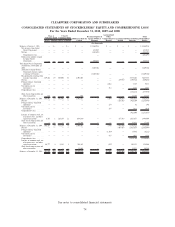

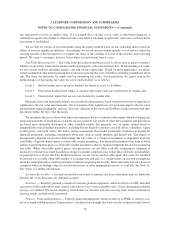

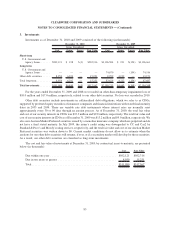

CLEARWIRE CORPORATION AND SUBSIDIARIES

CONSOLIDATED STATEMENTS OF CASH FLOWS

2010 2009 2008

Year Ended December 31,

(In thousands)

Cash flows from operating activities:

Net loss ........................................................ $(2,303,094) $(1,253,846) $ (592,347)

Adjustments to reconcile net loss to net cash used in operating activities:

Deferred income taxes . . . ......................................... (1,192) 712 61,607

Losses from equity investees, net . .................................... 1,971 1,202 174

Non-cash (gain)/loss on derivative instruments . . .......................... (63,255) (6,939) 6,072

Other-than-temporary impairment loss on investments . . ..................... — 10,015 17,036

Accretion of discount on debt . . . .................................... 6,113 66,375 1,667

Depreciation and amortization . . . .................................... 466,112 208,263 58,146

Amortization of spectrum leases . .................................... 57,433 57,898 17,109

Non-cash rent expense . . . ......................................... 200,901 108,953 —

Share-based compensation ......................................... 47,535 27,512 6,465

Loss on settlement of pre-existing lease arrangements . . ..................... — — 80,573

Loss on property, plant and equipment . . ............................... 349,512 60,874 —

Gain on extinguishment of debt . . .................................... — (8,252) —

Changes in assets and liabilities, net of effects of acquisition:

Inventory . ................................................... (4,808) (9,450) (892)

Accounts receivable ............................................. (20,104) (2,381) 402

Prepaids and other assets . ......................................... (74,600) (64,930) 6,354

Prepaid spectrum licenses. ......................................... (3,294) (23,861) (63,138)

Accounts payable and other liabilities . . . ............................... 172,057 355,371 (5,534)

Net cash used in operating activities . . ............................... (1,168,713) (472,484) (406,306)

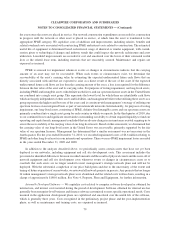

Cash flows from investing activities:

Capital expenditures . .............................................. (2,656,503) (1,450,238) (534,196)

Payments for spectrum licenses and other intangible assets . ..................... (15,428) (46,816) (109,257)

Purchases of available-for-sale investments . ............................... (2,098,705) (3,571,154) (1,774,324)

Disposition of available-for-sale investments ............................... 3,776,805 3,280,455 —

Net cash acquired in acquisition of Old Clearwire . .......................... — — 171,780

Other investing .................................................. (19,387) 4,754 167

Net cash used in investing activities . . ............................... (1,013,218) (1,782,999) (2,245,830)

Cash flows from financing activities:

Principal payments on long-term debt ................................... (876) (1,171,775) (3,573)

Proceeds from issuance of long-term debt . . ............................... 1,413,319 2,467,830 —

Debt financing fees . .............................................. (53,285) (44,217) (50,000)

Equity investment by strategic investors . . . ............................... 54,828 1,481,813 3,200,037

Proceeds from issuance of common stock . . ............................... 304,015 12,196 —

Net advances from Sprint Nextel Corporation .............................. — — 532,165

Sprint Nextel Corporation pre-closing financing . . . .......................... — — 392,196

Repayment of Sprint Nextel Corporation pre-closing financing . . . ................ — — (213,000)

Other financing .................................................. — — (70)

Net cash provided by financing activities .............................. 1,718,001 2,745,847 3,857,755

Effect of foreign currency exchange rates on cash and cash equivalents ............... (525) 1,510 524

Net (decrease) increase in cash and cash equivalents . .......................... (464,455) 491,874 1,206,143

Cash and cash equivalents:

Beginning of period . .............................................. 1,698,017 1,206,143 —

End of period ................................................... $1,233,562 $ 1,698,017 $ 1,206,143

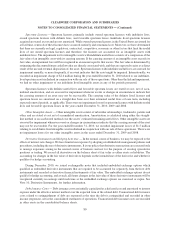

Supplemental cash flow disclosures:

Cash paid for interest including capitalized interest paid . . ..................... $ 336,314 $ 119,277 $ 7,432

Swap interest paid, net ............................................. $ — $ 13,915 $ —

Non-cash investing activities:

Fixed asset purchases in accounts payable and accrued expenses . . ................ $ 120,025 $ 89,792 $ 40,761

Fixed asset purchases financed by long-term debt . . .......................... $ 133,288 $ — $ —

Spectrum purchases in accounts payable . . . ............................... $ — $ — $ 10,560

Common stock of Sprint Nextel Corporation issued for spectrum licenses . ........... $ — $ — $ 4,000

Non-cash financing activities:

Conversion of Old Clearwire Class A shares into New Clearwire Class A shares . ...... $ — $ — $ 894,433

Vendor financing obligations ......................................... $ (60,251) $ — $ —

Capital lease obligations . . . ......................................... $ (73,037) $ — $ —

See notes to consolidated financial statements

73