Clearwire 2010 Annual Report Download - page 111

Download and view the complete annual report

Please find page 111 of the 2010 Clearwire annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Sprint and the Investors, other than Google, Inc., which we refer to as Google, own shares of Class B Common

Stock, which have equal voting rights to Clearwire’s $0.0001 par value, Class A Common Stock, but have only

limited economic rights. Unlike the holders of Class A Common Stock, the holders of Class B Common Stock have

no right to dividends and no right to any proceeds on liquidation other than the par value of the Class B Common

Stock. Sprint and the Investors, other than Google, hold their economic rights through ownership of Clearwire

Communications Class B Common Interests. Google owns shares of Class A Common Stock.

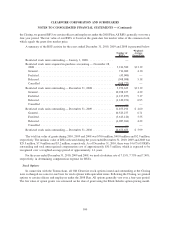

Under the Investment Agreement, Clearwire committed to a rights offering, pursuant to which rights to

purchase shares of Class A Common Stock were granted to each holder of Class A Common Stock along with

certain participating securities as of December 17, 2009, which we refer to as the Rights Offering. We distributed

subscription rights which were exercisable for up to 93,903,300 shares of Class A Common Stock. Each

subscription right entitled a shareholder to purchase 0.4336 shares of Class A Common Stock at a subscription

price of $7.33 per share. The subscription rights expired if they were not exercised by June 21, 2010. The

Participating Equityholders and Google waived their respective rights to participate in the Rights Offering with

respect to shares of Class A Common Stock they each hold as of the applicable record date. In connection with the

Rights Offering, rights to purchase 39.6 million shares of Class A Common Stock were exercised for an aggregate

purchase price of $290.3 million.

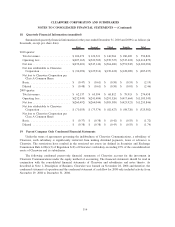

Clearwire Communications Interests

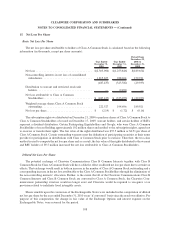

Clearwire is the sole holder of voting interests in Clearwire Communications. As such, Clearwire controls

100% of the decision making of Clearwire Communications and consolidates 100% of its operations. Clearwire

also holds all of the outstanding Clearwire Communications Class A Common Interests representing 25% of the

economics of Clearwire Communications as of December 31, 2010. The holders of the Class B Common Interests

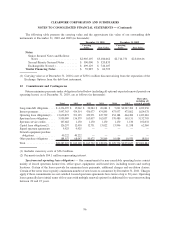

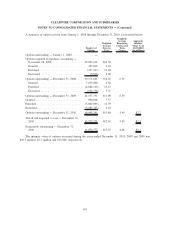

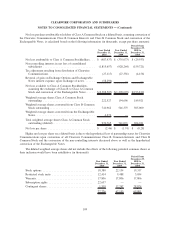

own the remaining 75% of the economic interests. The following shows the effects of the changes in Clearwire’s

ownership interests in Clearwire Communications (in thousands):

Year Ended

December 31,

2010

Year Ended

December 31,

2009

Period From

November 29,

2008 to

December 31,

2008

Net loss attributable to Clearwire .................. $(496,875) $(319,199) $(29,621)

Decrease in Clearwire’s additional paid-in capital for

issuance of Class A and B Common Stock related to

the post-closing adjustment . ................... — (33,632) —

Decrease in Clearwire’s additional paid-in capital for

issuance of Class B Common Stock .............. (64,569) (140,253) —

Increase in Clearwire’s additional paid-in capital for

issuance of Class A Common Stock .............. 301,849 17,957 161

Other effects of changes in Clearwire’s additional paid-

in capital for issuance of Class A and Class B

Common Stock ............................. 145,785 — —

Change from net loss attributable to Clearwire and

transfers to non-controlling interests .............. $(113,810) $(475,127) $(29,460)

The non-voting Clearwire Communication units are designated as either Clearwire Communications Class A

Common Interests, all of which are held by Clearwire, or Clearwire Communications Class B Common Interests,

which are held by Sprint and the Investors, with the exception of Google. Both classes of non-voting Clearwire

Communication units participate in distributions of Clearwire Communications on an equal and proportionate

basis.

106

CLEARWIRE CORPORATION AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — (Continued)