Clearwire 2010 Annual Report Download - page 73

Download and view the complete annual report

Please find page 73 of the 2010 Clearwire annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Stock Price Risk

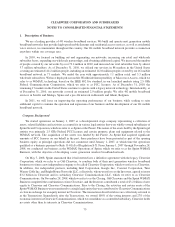

The Exchange Options embedded in the Exchangeable Notes issued in December 2010 constitute derivative

liabilities that are required to be separately accounted for from the debt host instrument at fair value. Input

assumptions used to model the estimated fair value of the Exchange Options include our stock price, our stock’s

volatility and carrying costs. The value of the Exchange Options are sensitive to both the price of our Class A

Common Stock and volatility of our stock. Holding all other pricing assumptions constant, an increase or decrease

of $1.00 on our stock price could result in a loss of $69.0 million or a gain of $59.7 million, respectively. Our stock’s

volatility is an input assumption requiring significant judgment. Holding all other pricing assumptions constant, an

increase or decrease of 10% in our estimated stock volatility could result in a loss of $51.5 million or a gain of

$53.6 million, respectively.

Foreign Currency Exchange Rate Risk

We are exposed to foreign currency exchange rate risk as it relates to our international operations. We currently

do not hedge our currency exchange rate risk and, as such, we are exposed to fluctuations in the value of the United

States dollar against other currencies. Our international subsidiaries and equity investees generally use the currency

of the jurisdiction in which they reside, or local currency, as their functional currency. Assets and liabilities are

translated at exchange rates in effect as of the balance sheet date and the resulting translation adjustments are

recorded within accumulated other comprehensive income (loss). Income and expense accounts are translated at the

average monthly exchange rates during the reporting period. The effects of changes in exchange rates between the

designated functional currency and the currency in which a transaction is denominated are recorded as foreign

currency transaction gains (losses) and recorded in the consolidated statement of operations. We believe that the

fluctuation of foreign currency exchange rates did not have a material impact on our consolidated financial

statements.

Credit Risk

At December 31, 2010, we held available-for-sale short-term and long-term investments with a fair value and

carrying value of $517.6 million and a cost of $511.1 million, comprised of United States Government and Agency

Issues and other debt securities. We regularly review the carrying value of our short-term and long-term investments

and identify and record losses when events and circumstances indicate that declines in the fair value of such assets

below our accounting basis are other-than-temporary. Approximately 34% of our investments at December 31,

2010 were concentrated in United States Treasury Securities that are considered the least risky investment available

to United States investors. The remainder of our portfolio is primarily comprised of United States agency and other

debentures. The estimated fair values of these investments are subject to fluctuations due to volatility of the credit

markets in general, company-specific circumstances, changes in general economic conditions and use of man-

agement judgment when observable market prices and parameters are not fully available.

Other debt securities are variable rate debt instruments whose interest rates are normally reset approximately

every 30 or 90 days through an auction process. A portion of our investments in other debt securities represent

interests in collateralized debt obligations, which we refer to as CDOs, supported by preferred equity securities of

insurance companies and financial institutions with stated final maturity dates in 2033 and 2034. As of Decem-

ber 31, 2010 the total fair value and carrying value of our security interests in CDOs was $15.3 million and our cost

was $9.0 million. We also own other debt securities, with a carrying value and cost of $0 at December 31, 2010, that

are Auction Rate Market Preferred securities issued by a monoline insurance company. These securities are

perpetual and do not have a final stated maturity.

68