Clearwire 2010 Annual Report Download - page 108

Download and view the complete annual report

Please find page 108 of the 2010 Clearwire annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

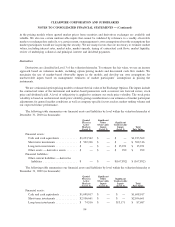

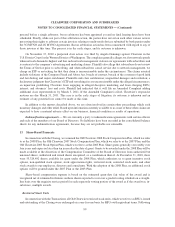

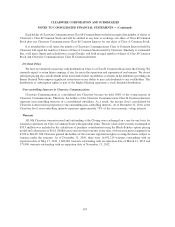

Share-based compensation expense recognized for all plans for the years ended December 31, 2010, 2009 and

2008 is as follows (in thousands):

2010 2009 2009

Year Ended December 31.

Options .............................................. $16,749 $ 6,386 $2,371

RSUs ............................................... 30,582 20,091 1,292

Sprint Equity Compensation Plans .......................... 204 1,035 2,802

$47,535 $27,512 $6,465

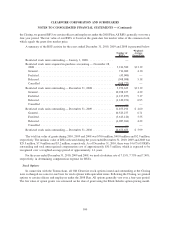

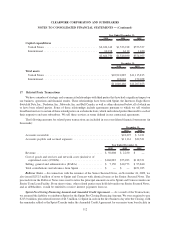

During the years ended December 31, 2010, 2009 and 2008, we recorded $10.9 million, $2.4 million and $0,

respectively, of additional compensation expense related to the accelerated vesting of options and RSUs.

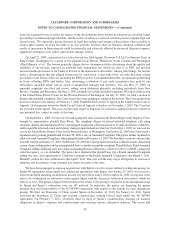

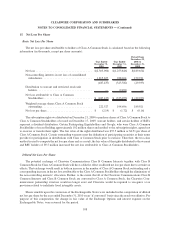

Sprint Equity Compensation Plans

In connection with the Transactions, certain of the Sprint WiMAX Business employees became employees of

Clearwire and currently hold unvested Sprint stock options and RSUs in Sprint’s equity compensation plans, which

we refer to collectively as the Sprint Plans. The underlying share for awards issued under the Sprint Plans is Sprint

common stock. The Sprint Plans allow for continued plan participation as long as the employee remains employed

by a Sprint subsidiary or affiliate. Under the Sprint Plans, options are generally granted with an exercise price equal

to the market value of the underlying shares on the grant date, generally vest over a period of up to four years and

have a contractual term of ten years. RSUs generally have both performance and service requirements with vesting

periods ranging from one to three years. RSUs granted after the second quarter 2008 included quarterly perfor-

mance targets but were not granted until performance targets were met. Therefore, at the grant date these awards

only had a remaining service requirement and vesting period of six months following the last day of the applicable

quarter. Employees who were granted RSUs were not required to pay for the shares but generally must remain

employed with Sprint or a subsidiary, until the restrictions lapse, which was typically three years or less. At

December 31, 2010, there were 35,257 unvested options and 66,451 unvested RSUs outstanding.

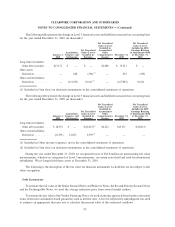

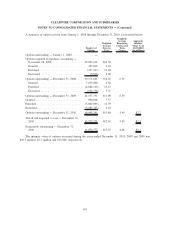

The share-based compensation associated with these employees is incurred by Sprint on our behalf. Sprint

provided us with the fair value of the options and RSUs for each reporting period, which must be remeasured based

on the fair value of the equity instruments at each reporting period until the instruments are vested. Total

unrecognized share-based compensation costs related to unvested stock options and RSUs outstanding as of

December 31, 2010 was $6,000 and $27,000, respectively, and is expected to be recognized over approximately one

year.

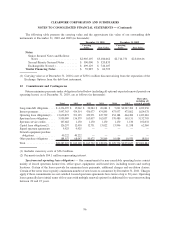

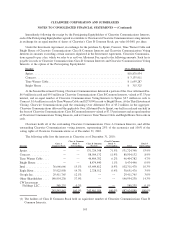

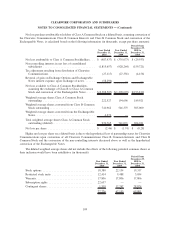

14. Stockholders’ Equity

Class A Common Stock

The Class A Common Stock represents the common equity of Clearwire. The holders of the Class A Common

Stock are entitled to one vote per share and, as a class, are entitled to 100% of any dividends or distributions made by

Clearwire, with the exception of certain minimal liquidation rights provided to the Class B Common Stockholders,

which are described below. Each share of Class A Common Stock participates ratably in proportion to the total

number of shares of Class A Common Stock issued by Clearwire. Holders of Class A Common Stock have 100% of

the economic interest in Clearwire and are considered the controlling interest for the purposes of financial reporting.

Upon liquidation, dissolution or winding up, the Class A Common Stock will be entitled to any assets

remaining after payment of all debts and liabilities of Clearwire, with the exception of certain minimal liquidation

rights provided to the Class B Common Stockholders, which are described below.

103

CLEARWIRE CORPORATION AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — (Continued)