Clearwire 2010 Annual Report Download - page 110

Download and view the complete annual report

Please find page 110 of the 2010 Clearwire annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

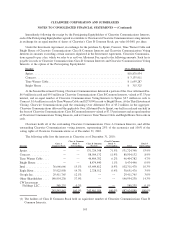

Immediately following the receipt by the Participating Equityholders of Clearwire Communications Interests,

each of the Participating Equityholders agreed to contribute to Clearwire its Clearwire Communications voting interests

in exchange for an equal number of shares of Clearwire’s Class B Common Stock, par value $0.0001 per share.

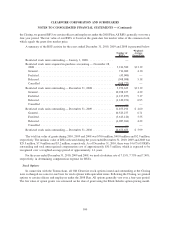

Under the Investment Agreement, in exchange for the purchase by Sprint, Comcast, Time Warner Cable and

Bright House of Clearwire Communications Class B Common Interests and Clearwire Communications Voting

Interests in amounts exceeding certain amounts stipulated in the Investment Agreement, Clearwire Communica-

tions agreed to pay a fee, which we refer to as an Over Allotment Fee, equal to the following amounts. Such fee is

payable in cash, or Clearwire Communications Class B Common Interests and Clearwire Communications Voting

Interests, at the option of the Participating Equityholder:

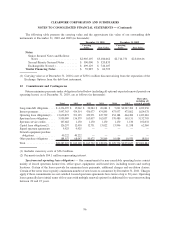

Investor Over Allotment Fee

Sprint ......................................................... $18,878,934

Comcast ....................................................... $ 3,135,911

Time Warner Cable ............................................... $ 1,659,287

Bright House . .................................................. $ 315,325

At the Second Investment Closing, Clearwire Communications delivered a portion of the Over Allotment Fee,

$6.9 million in cash and $9.5 million in Clearwire Communications Class B Common Interests, valued at $7.33 per

interest, and an equal number of Clearwire Communications Voting Interests to Sprint, $2.7 million in cash to

Comcast, $1.4 million in cash to Time Warner Cable and $275,000 in cash to Bright House. At the Third Investment

Closing, Clearwire Communications paid the remaining Over Allotment Fee of $3.2 million, in the aggregate.

Clearwire Communications delivered the applicable Over Allotment Fee to Sprint, one-half in cash and one-half in

the form of Clearwire Communications Class B Common Interests valued at $7.33 per interest and an equal number

of Clearwire Communications Voting Interests, and to Comcast, Time Warner Cable and Bright House Networks in

cash.

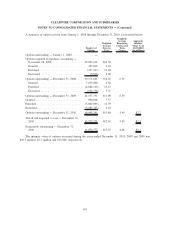

Clearwire holds all of the outstanding Clearwire Communications Class A Common Interests, and all the

outstanding Clearwire Communications voting interests, representing 25% of the economics and 100% of the

voting rights of Clearwire Communications as of December 31, 2010.

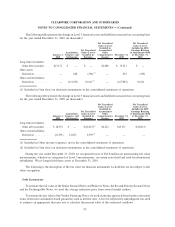

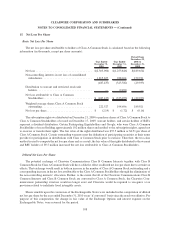

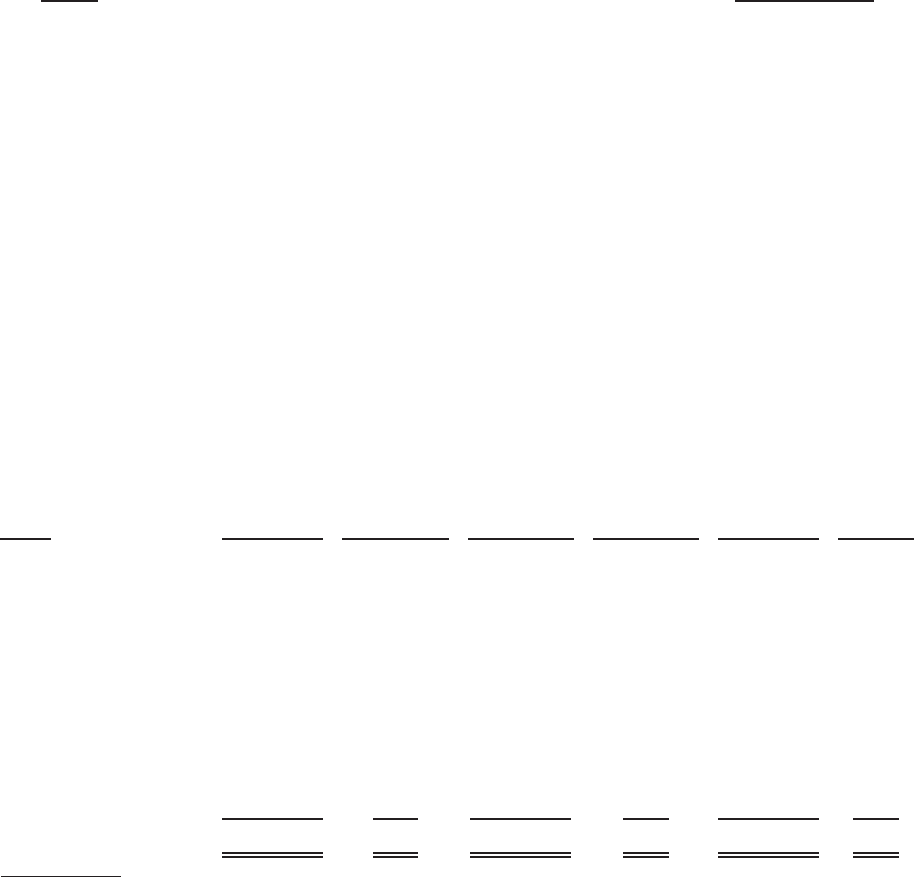

The following table lists the interests in Clearwire as of December 31, 2010:

Investor

Class A

Common Stock

Class A Common

Stock %

Outstanding

Class B Common

Stock(1)

Class B Common

Stock %

Outstanding Total

Total %

Outstanding

Sprint .............. — — 531,724,348 71.5% 531,724,348 53.9%

Comcast ............ — — 88,504,132 11.9% 88,504,132 8.9%

Time Warner Cable .... — — 46,404,782 6.2% 46,404,782 4.7%

Bright House ........ — — 8,474,440 1.1% 8,474,440 0.9%

Intel ............... 36,666,666 15.1% 65,644,812 8.9% 102,311,478 10.3%

Eagle River.......... 35,922,958 14.7% 2,728,512 0.4% 38,651,470 3.9%

Google Inc. ......... 29,411,765 12.1% — — 29,411,765 3.0%

Other Shareholders .... 140,954,238 57.9% — — 140,954,238 14.3%

CW Investment

Holdings LLC ...... 588,235 0.2% — — 588,235 0.1%

243,543,862 100.0% 743,481,026 100.0% 987,024,888 100.0%

(1) The holders of Class B Common Stock hold an equivalent number of Clearwire Communications Class B

Common Interests.

105

CLEARWIRE CORPORATION AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — (Continued)