Clearwire 2010 Annual Report Download - page 60

Download and view the complete annual report

Please find page 60 of the 2010 Clearwire annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Our long-lived assets, consisting of PP&E and definite-lived intangible assets such as subscriber relationships

and our spectrum licenses in the United States, are combined into a single asset group for purposes of testing

impairment because management believes that utilizing these assets as a group represents the highest and best use of

the assets and is consistent with the management’s strategy of utilizing our spectrum licenses on an integrated basis

as part of our nationwide network. Internationally, our long-lived assets, consisting of PP&E, definite-lived

intangible assets such as subscriber relationships, and our spectrum assets are primarily combined into a single asset

group for each country in which we operate for purposes of testing impairment.

In the third quarter of 2010, due to our continued losses and significant uncertainties surrounding our ability to

obtain required liquidity to fund our operating and capital needs, management concluded that an adverse change in

circumstances existed requiring us to assess the recoverability of the carrying value of our long-lived assets. Based

on this assessment, we determined that the carrying value of our long-lived assets in the United States was

recoverable, primarily supported by the fair value of our spectrum licenses. Management has determined that a

similar assessment was not necessary in the fourth quarter.

Property, Plant & Equipment

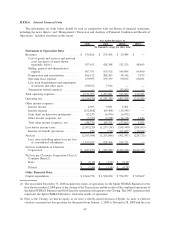

A significant portion of our total assets is PP&E. PP&E represented $4.46 billion of our $11.04 billion in total

assets as of December 31, 2010. We generally calculate depreciation on these assets using the straight-line method

based on estimated economic useful lives. The estimated useful life of equipment is determined based on historical

usage of identical or similar equipment, with consideration given to technological changes and industry trends that

could impact the network architecture and asset utilization. Since changes in technology or in our intended use of

these assets, as well as changes in broad economic or industry factors, may cause the estimated period of use of

these assets to change, we periodically review these factors to assess the remaining life of our asset base. When

these factors indicate that an asset’s useful life is different from the previous assessment, we depreciate the

remaining book values prospectively over the adjusted remaining estimated useful life.

We capitalize certain direct costs, including certain salary and benefit costs and overhead costs, incurred to

prepare the asset for its intended use. We also capitalize interest associated with certain acquisition or construction

costs of network-related assets. Capitalized interest and direct costs are reported as part of the cost of the network-

related assets and as a reduction in the related expense in the statement of operations.

We periodically assess certain assets that have not yet been deployed in our networks, including network

equipment and cell site development costs. This assessment includes the write-off of network equipment for

estimated shrinkage experienced during the deployment process and the write-down of network equipment and cell

site development costs whenever events or changes in circumstances cause us to conclude that such assets are no

longer needed to meet our strategic network plans and will not be deployed. With the substantial completion of our

prior build plans and due to the uncertainty of the extent and timing of future expansion of our networks, we

reviewed all network projects in process. Any network projects in process that no longer fit within management’s

strategic network plans were abandoned and the related costs written down. As we continue to revise our build plans

in response to changes in our strategy, funding availability, technology and industry trends, additional projects could

be identified for abandonment, for which the associated write-downs could be material.

Derivative Valuation

Derivative financial instruments are recorded as either assets or liabilities on our consolidated balance sheet at

their fair value on the date of issuance and are remeasured to fair value on each subsequent balance sheet date until

such instruments are exercised or expire, with any changes in the fair value between reporting periods recorded as

Other income or expense. At December 31, 2010, derivative financial instruments requiring revaluation are

composed primarily of the exchange options, which we refer to as Exchange Options, embedded in our

Exchangeable Notes issued in December 2010 that were required to be accounted for separately from the debt

host contract.

55

CLEARWIRE CORPORATION AND SUBSIDIARIES — (Continued)