Clearwire 2010 Annual Report Download - page 88

Download and view the complete annual report

Please find page 88 of the 2010 Clearwire annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

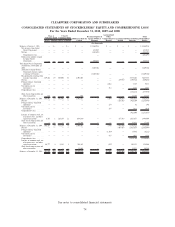

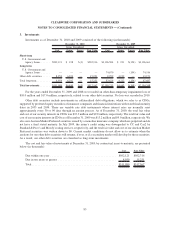

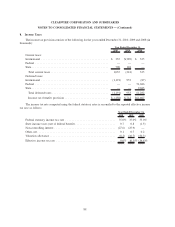

3. Investments

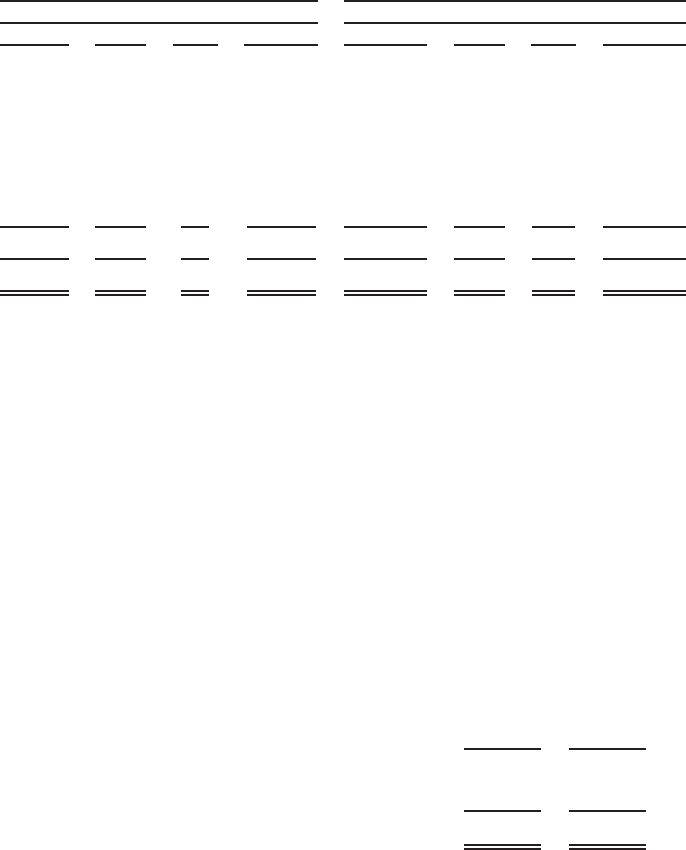

Investments as of December 31, 2010 and 2009 consisted of the following (in thousands):

Cost Gains Losses Fair Value Cost Gains Losses Fair Value

Gross Unrealized Gross Unrealized

December 31, 2010 December 31, 2009

Short-term

U.S. Government and

Agency Issues ...... $502,121 $ 198 $ (3) $502,316 $2,106,584 $ 231 $(154) $2,106,661

Long-term

U.S. Government and

Agency Issues ...... — — — — 74,670 — (154) 74,516

Other debt securities ..... 8,959 6,292 — 15,251 8,959 4,212 — 13,171

Total long-term . ........ 8,959 6,292 — 15,251 83,629 4,212 (154) 87,687

Total investments ....... $511,080 $6,490 $ (3) $517,567 $2,190,213 $4,443 $(308) $2,194,348

For the years ended December 31, 2009 and 2008 we recorded an other-than-temporary impairment loss of

$10.0 million and $17.0 million, respectively, related to our other debt securities. No loss was recorded in 2010.

Other debt securities include investments in collateralized debt obligations, which we refer to as CDOs,

supported by preferred equity securities of insurance companies and financial institutions with stated final maturity

dates in 2033 and 2034. These are variable rate debt instruments whose interest rates are normally reset

approximately every 30 or 90 days through an auction process. As of December 31, 2010, the total fair value

and cost of our security interests in CDOs was $15.3 million and $9.0 million, respectively. The total fair value and

cost of our security interests in CDOs as of December 31, 2009 was $13.2 million and $9.0 million, respectively. We

also own Auction Market Preferred securities issued by a monoline insurance company which are perpetual and do

not have a final stated maturity. In July 2009, the issuer’s credit rating was downgraded to CC and Caa2 by

Standard & Poor’s and Moody’s rating services, respectively, and the total fair value and cost of our Auction Market

Preferred securities was written down to $0. Current market conditions do not allow us to estimate when the

auctions for our other debt securities will resume, if ever, or if a secondary market will develop for these securities.

As a result, our other debt securities are classified as long-term investments.

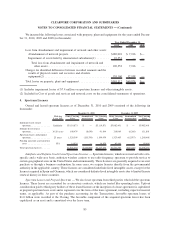

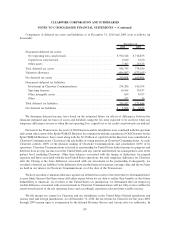

The cost and fair value of investments at December 31, 2010, by contractual years-to-maturity, are presented

below (in thousands):

Cost Fair Value

Due within one year .......................................... $502,121 $502,316

Due in ten years or greater ..................................... 8,959 15,251

Total ...................................................... $511,080 $517,567

83

CLEARWIRE CORPORATION AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — (Continued)