Clearwire 2010 Annual Report Download - page 83

Download and view the complete annual report

Please find page 83 of the 2010 Clearwire annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.any anticipated recovery in market value. If it is judged that a decline in fair value is other-than-temporary, a

realized loss equal to the decline is reflected in the consolidated statement of operations, and a new cost basis in the

investment is established.

We account for certain of our investments using the equity method based on our ownership interest and our

ability to exercise significant influence. Accordingly, we record our investment initially at cost and we adjust the

carrying amount of the investment to recognize our share of the earnings or losses of the investee each reporting

period. We cease to recognize investee losses when our investment basis is zero.

Fair Value Measurements — Fair value is the price that would be received to sell an asset or paid to transfer a

liability in an orderly transaction between market participants at the measurement date. In determining fair value,

we use various methods including market, cost and income approaches. Based on these approaches, we utilize

certain assumptions that market participants would use in pricing the asset or liability, including assumptions about

risk. The three-tier hierarchy for inputs used in measuring fair value, which prioritizes the inputs used in the

methodologies of measuring fair value for assets and liabilities, is as follows:

Level 1: Quoted market prices in active markets for identical assets or liabilities

Level 2: Observable market based inputs or unobservable inputs that are corroborated by market data

Level 3: Unobservable inputs that are not corroborated by market data

Financial assets and financial liabilities are classified in their entirety based on the lowest level of input that is

significant to the fair value measurements. Our assessment of the significance of a particular input to the fair value

measurement requires judgment, and may affect the valuation of the assets and liabilities being measured and their

placement within the fair value hierarchy.

We maximize the use of observable inputs and minimize the use of unobservable inputs when developing fair

value measurements. If listed prices or quotes are not available, fair values of other debt securities and derivatives

are based upon internally developed or other available models that primarily use, as inputs, market-based or

independently sourced market parameters, including but not limited to interest rate yield curves, volatilities, equity

or debt prices, and credit curves. We utilize certain assumptions that market participants would use in pricing the

financial instrument, including assumptions about risk, such as credit, inherent and default risk. The degree of

management judgment involved in determining the fair value of a financial instrument is dependent upon the

availability of quoted market prices or observable market parameters. For financial instruments that trade actively

and have quoted market prices or observable market parameters, there is minimal judgment involved in measuring

fair value. When observable market prices and parameters are not fully available, management judgment is

necessary to estimate fair value. In addition, changes in market conditions may reduce the availability and reliability

of quoted prices or observable data. In these instances, we use certain unobservable inputs that cannot be validated

by reference to a readily observable market or exchange data and rely, to a certain extent, on our own assumptions

about the assumptions that a market participant would use in pricing the security. These internally derived values are

compared with non-binding values received from brokers or other independent sources, as available. See Note 11,

Fair Value, for further information.

Accounts Receivable — Accounts receivables are stated at amounts due from subscribers and our wholesale

partners net of an allowance for doubtful accounts.

Inventory — Inventory primarily consists of customer premise equipment, which we refer to as CPE, and other

accessories sold to subscribers and is stated at the lower of cost or net realizable value. Cost is determined under the

average cost method. We record inventory write-downs for obsolete and slow-moving items based on inventory

turnover trends and historical experience.

Property, Plant and Equipment — Property, plant and equipment, which we refer to as PP&E, is stated at cost,

net of accumulated depreciation. Depreciation is calculated on a straight-line basis over the estimated useful lives of

78

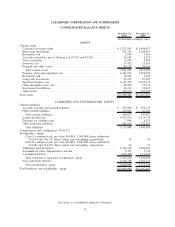

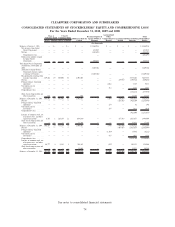

CLEARWIRE CORPORATION AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — (Continued)