Clearwire 2010 Annual Report Download - page 81

Download and view the complete annual report

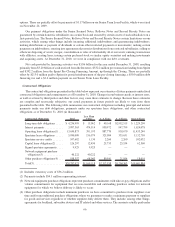

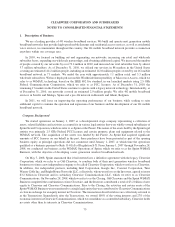

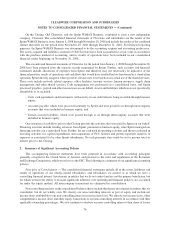

Please find page 81 of the 2010 Clearwire annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.On the Closing, Old Clearwire, and the Sprint WiMAX Business, combined to form a new independent

company, Clearwire. The consolidated financial statements of Clearwire and subsidiaries are the results of the

Sprint WiMAX Business, from January 1, 2008 through November 28, 2008 and include the results of the combined

entities thereafter for the period from November 29, 2008 through December 31, 2010. For financial reporting

purposes, the Sprint WiMAX Business was determined to be the accounting acquirer and accounting predecessor.

The assets acquired and liabilities assumed of Old Clearwire have been accounted for at fair value in accordance

with the purchase method of accounting, and its results of operations have been included in our consolidated

financial results beginning on November 29, 2008.

The accounts and financial statements of Clearwire for the period from January 1, 2008 through November 28,

2008 have been prepared from the separate records maintained by Sprint. Further, such accounts and financial

statements include allocations of expenses from Sprint and therefore may not necessarily be indicative of the

financial position, results of operations and cash flows that would have resulted had we functioned as a stand-alone

operation. Sprint directly assigned, where possible, certain costs to us based on our actual use of the shared services.

These costs include network related expenses, office facilities, treasury services, human resources, supply chain

management and other shared services. Cash management was performed on a consolidated basis, and Sprint

processed payables, payroll and other transactions on our behalf. Assets and liabilities which were not specifically

identifiable to us included:

• Cash, cash equivalents and investments, with activity in our cash balances being recorded through business

equity;

• Accounts payable, which were processed centrally by Sprint and were passed to us through intercompany

accounts that were included in business equity; and

• Certain accrued liabilities, which were passed through to us through intercompany accounts that were

included in business equity.

Our statement of cash flows prior to the Closing presents the activities that were paid by Sprint on our behalf.

Financing activities include funding advances from Sprint, presented as business equity, since Sprint managed our

financing activities on a centralized basis. Further, the net cash used in operating activities and the net cash used in

investing activities for capital expenditures and acquisitions of FCC licenses and patents represent transfers of

expenses or assets paid for by other Sprint subsidiaries. No cash payments were made by us for income taxes or

interest prior to the Closing.

2. Summary of Significant Accounting Policies

The accompanying financial statements have been prepared in accordance with accounting principles

generally accepted in the United States of America and pursuant to the rules and regulations of the Securities

and Exchange Commission, which we refer to as the SEC. The following is a summary of our significant accounting

policies:

Principles of Consolidation — The consolidated financial statements include all of the assets, liabilities and

results of operations of our wholly-owned subsidiaries, and subsidiaries we control or in which we have a

controlling financial interest. Investments in entities that we do not control and are not the primary beneficiary, but

for which we have the ability to exercise significant influence over operating and financial policies, are accounted

for under the equity method. All intercompany transactions are eliminated in consolidation.

Non-controlling interests on the consolidated balance sheets include third-party investments in entities that we

consolidate, but do not wholly own. We classify our non-controlling interests as part of equity and include net

income (loss) attributable to our non-controlling interests in net income (loss). We allocate net income (loss), other

comprehensive income (loss) and other equity transactions to our non-controlling interests in accordance with their

applicable ownership percentages. We also continue to attribute our non-controlling interests their share of losses

76

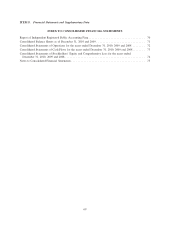

CLEARWIRE CORPORATION AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — (Continued)