Clearwire 2010 Annual Report Download - page 106

Download and view the complete annual report

Please find page 106 of the 2010 Clearwire annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

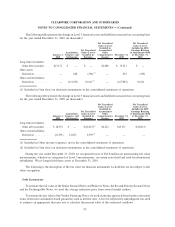

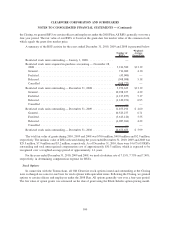

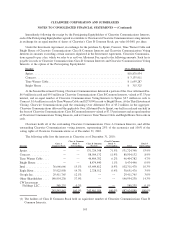

A summary of option activity from January 1, 2008 through December 31, 2010 is presented below:

Number of

Options

Weighted-

Average

Exercise

Price

Weighted-

Average

Remaining

Contractual

Term

(Years)

Aggregate

Intrinsic

Value As of

12/31/2010

(In millions)

Options outstanding — January 1, 2008 ...... —

Options acquired in purchase accounting —

November 28, 2008 ................... 19,093,614 $14.38

Granted ............................ 425,000 4.10

Forfeited ........................... (337,147) 11.64

Exercised ........................... (9,866) 3.00

Options outstanding — December 31, 2008 .... 19,171,601 $14.21 6.36

Granted ............................ 7,075,000 4.30

Forfeited ........................... (4,084,112) 15.13

Exercised ........................... (624,758) 3.51

Options outstanding — December 31, 2009 .... 21,537,731 $11.09 6.39

Granted . . ............................ 996,648 7.37

Forfeited . ............................ (3,007,895) 12.79

Exercised. ............................ (3,083,243) 4.44

Options outstanding — December 31, 2010 .... 16,443,241 $11.80 5.69 $7.7

Vested and expected to vest — December 31,

2010 . . ............................ 15,773,721 $12.01 5.59 $7.2

Exercisable outstanding — December 31,

2010 . . ............................ 11,074,772 $13.93 4.68 $3.3

The intrinsic value of options exercised during the years ended December 31, 2010, 2009 and 2008 was

$10.5 million, $2.3 million and $15,000, respectively.

101

CLEARWIRE CORPORATION AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — (Continued)