Clearwire 2010 Annual Report Download - page 118

Download and view the complete annual report

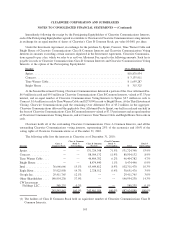

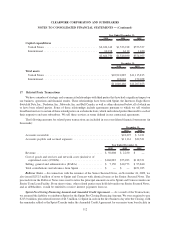

Please find page 118 of the 2010 Clearwire annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.the amount of $179.2 million. During 2009, we repaid our senior term loan facility with proceeds from our Senior

Secured Notes and Rollover Notes.

Sprint — Sprint assigned, where possible, certain costs to us based on our actual use of the shared services,

which included office facilities and management services, including treasury services, human resources, supply

chain management and other shared services, up through the Closing. Where direct assignment of costs was not

possible or practical, Sprint used indirect methods, including time studies, to estimate the assignment of its costs to

us, which were allocated to us through a management fee. The allocations of these costs were re-evaluated

periodically. Sprint charged us management fees for such services of $171.1 million in the year ended December 31,

2008. Additionally, we have entered into lease agreements with Sprint for various switching facilities and

transmitter and receiver sites for which we recorded rent expense of $36.4 million in the year ended December 31,

2008.

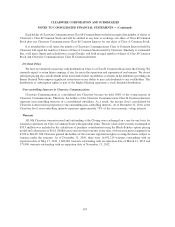

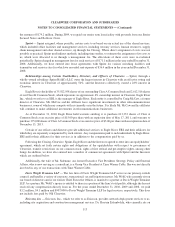

Relationships among Certain Stockholders, Directors, and Officers of Clearwire — Sprint, through a

wholly-owned subsidiary Sprint HoldCo LLC, owns the largest interest in Clearwire with an effective voting and

economic interest in Clearwire of approximately 54%, and the Investors collectively owned a 28% interest in

Clearwire.

Eagle River is the holder of 35,922,958 shares of our outstanding Class A Common Stock and 2,612,516 shares

of our Class B Common Stock, which represents an approximate 4% ownership interest in Clearwire. Eagle River

Inc., which we refer to as ERI, is the manager of Eagle River. Each entity is controlled by Craig McCaw, a former

director of Clearwire. Mr. McCaw and his affiliates have significant investments in other telecommunications

businesses, some of which may compete with us currently or in the future. It is likely Mr. McCaw and his affiliates

will continue to make additional investments in telecommunications businesses.

As of December 31, 2010, Eagle River held warrants entitling it to purchase 613,333 shares of Class A

Common Stock at an exercise price of $15.00 per share with an expiration date of May 17, 2011, and warrants to

purchase 375,000 shares of Class A Common Stock at an exercise price of $3.00 per share with an expiration date of

November 13, 2013.

Certain of our officers and directors provide additional services to Eagle River, ERI and their affiliates for

which they are separately compensated by such entities. Any compensation paid to such individuals by Eagle River,

ERI and/or their affiliates for their services is in addition to the compensation paid by us.

Following the Closing, Clearwire, Sprint, Eagle River and the Investors agreed to enter into an equityholders’

agreement, which set forth certain rights and obligations of the equityholders with respect to governance of

Clearwire, transfer restrictions on our common stock, rights of first refusal and pre-emptive rights, among other

things. In addition, we have also entered into a number of commercial agreements with Sprint and the Investors

which are outlined below.

Additionally, the wife of Mr. Salemme, our former Executive Vice President, Strategy, Policy and External

Affairs, who is now serving as a consultant, is a Group Vice President at Time Warner Cable. She was not directly

involved in any of our transactions with Time Warner Cable.

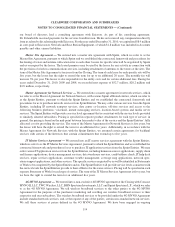

Davis Wright Tremaine LLP — The law firm of Davis Wright Tremaine LLP serves as our primary outside

counsel, and handles a variety of corporate, transactional, tax and litigation matters. Mr. Wolff, who currently sits on

our board of directors and is our former Chief Executive Officer, is married to a partner at Davis Wright Tremaine

LLP. As a partner, Mr. Wolff’s spouse is entitled to share in a portion of the firm’s total profits, although she has not

received any compensation directly from us. For the years ended December 31, 2010, 2009 and 2008, we paid

$3.2 million, $4.1 million and $907,000 to Davis Wright Tremaine LLP for legal services, respectively. This does

not include fees paid by Old Clearwire.

Ericsson, Inc — Ericsson, Inc., which we refer to as Ericsson, provides network deployment services to us,

including site acquisition and construction management services. Dr. Hossein Eslambolchi, who currently sits on

113

CLEARWIRE CORPORATION AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — (Continued)