Clearwire 2010 Annual Report Download - page 87

Download and view the complete annual report

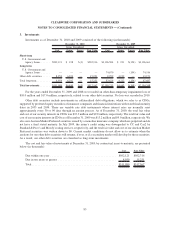

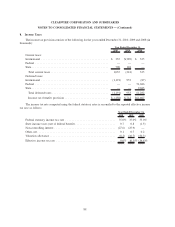

Please find page 87 of the 2010 Clearwire annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.period. Diluted net loss per Class A Common Share is computed by dividing net loss attributable to Clearwire

Corporation by the weighted-average number of Class A Common Shares and dilutive Class A Common Share

equivalents outstanding during the period. Class A Common Share equivalents generally consist of the Class A

Common Shares issuable upon the exercise of outstanding stock options, warrants and restricted stock using the

treasury stock method. The effects of potentially dilutive Class A Common Share equivalents are excluded from the

calculation of diluted net loss per Class A Common Share if their effect is antidilutive. We have two classes of

common stock, Class A and Class B. The potential exchange of Clearwire Communications Class B common

interests together with Class B common stock for Clearwire Class A common stock may have a dilutive effect on

diluted net loss per share due to certain tax effects. On an “if converted” basis, shares issuable upon the conversion

of the exchangeable notes may have a dilutive effect on diluted net loss per share. See Note 15, Net Loss Per Share,

for further information.

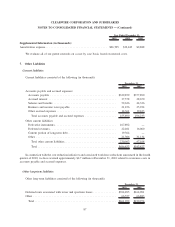

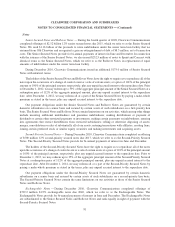

Operating Leases — We have operating leases for spectrum licenses, towers and certain facilities, and

equipment for use in our operations. Certain of our spectrum licenses are leased from third-party holders of

Educational Broadband Service, which we refer to as EBS, spectrum licenses granted by the FCC. EBS licenses

authorize the provision of certain communications services on the EBS channels in certain markets throughout the

United States. We account for these spectrum leases as executory contracts which are similar to operating leases.

Signed leases which have unmet conditions required to become effective are not amortized until such conditions are

met and are included in spectrum licenses in the accompanying consolidated balance sheets, if such leases require

upfront payments. For leases containing scheduled rent escalation clauses, we record minimum rental payments on

a straight-line basis over the term of the lease, including the expected renewal periods as appropriate. For leases

containing tenant improvement allowances and rent incentives, we record deferred rent, which is a liability, and that

deferred rent is amortized over the term of the lease, including the expected renewal periods as appropriate, as a

reduction to rent expense.

Foreign Currency — Our international subsidiaries generally use their local currency as their functional

currency. Assets and liabilities are translated at exchange rates in effect at the balance sheet date. Resulting

translation adjustments are recorded within accumulated other comprehensive income (loss). Income and expense

accounts are translated at the average monthly exchange rates. The effects of changes in exchange rates between the

designated functional currency and the currency in which a transaction is denominated are recorded as foreign

currency transaction gains (losses) and recorded in the consolidated statement of operations.

Concentration of Risk — We believe that the geographic diversity of our subscriber base and retail nature of

our product minimizes the risk of incurring material losses due to concentrations of credit risk.

Recent Accounting Pronouncements

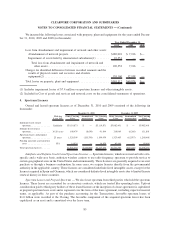

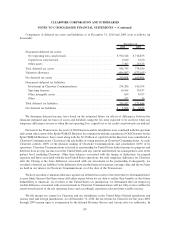

In October 2009, the Financial Accounting Standards Board, which we refer to as the FASB, issued new

accounting guidance that amends the revenue recognition for multiple-element arrangements and expands the

disclosure requirements related to such arrangements. The new guidance amends the criteria for separating

consideration in multiple-deliverable arrangements, establishes a selling price hierarchy for determining the selling

price of a deliverable, eliminates the residual method of allocation, and requires the application of relative selling

price method in allocating the arrangement consideration to all deliverables. The new accounting guidance is

effective for fiscal years beginning after June 15, 2010. We will adopt the new accounting guidance beginning

January 1, 2011. We do not anticipate the adoption of the new accounting guidance to have a significant effect on

our financial condition or results of operations.

82

CLEARWIRE CORPORATION AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — (Continued)