Clearwire 2010 Annual Report Download - page 121

Download and view the complete annual report

Please find page 121 of the 2010 Clearwire annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

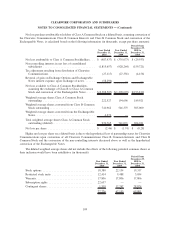

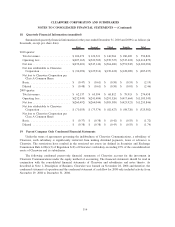

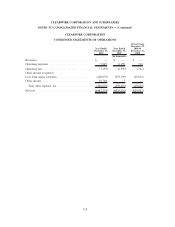

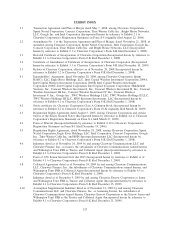

18. Quarterly Financial Information (unaudited)

Summarized quarterly financial information for the years ended December 31, 2010 and 2009 is as follows (in

thousands, except per share data):

First Second Third Fourth Total

2010 quarter:

Total revenues ................... $106,672 $ 122,521 $ 146,964 $ 180,669 $ 556,826

Operating loss ................... $(407,165) $(520,769) $(539,727) $(747,218) $(2,214,879)

Net loss . ....................... $(439,401) $(547,142) $(564,606) $(751,945) $(2,303,094)

Net loss attributable to Clearwire

Corporation ................... $ (94,092) $(125,916) $(139,420) $(128,009) $ (487,437)

Net loss to Clearwire Corporation per

Class A Common Share:

Basic . . . ....................... $ (0.47) $ (0.61) $ (0.58) $ (0.53) $ (2.19)

Diluted . ....................... $ (0.48) $ (0.61) $ (0.58) $ (0.81) $ (2.46)

2009 quarter:

Total revenues ................... $ 62,137 $ 63,594 $ 68,812 $ 79,915 $ 274,458

Operating loss ................... $(232,949) $(241,404) $(291,326) $(417,664) $(1,183,343)

Net loss . ....................... $(260,492) $(264,044) $(305,389) $(423,921) $(1,253,846)

Net loss attributable to Clearwire

Corporation ................... $ (71,055) $ (73,374) $ (82,427) $ (98,726) $ (325,582)

Net loss to Clearwire Corporation per

Class A Common Share:

Basic . . . ....................... $ (0.37) $ (0.38) $ (0.42) $ (0.55) $ (1.72)

Diluted . ....................... $ (0.38) $ (0.38) $ (0.43) $ (0.55) $ (1.74)

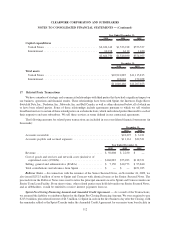

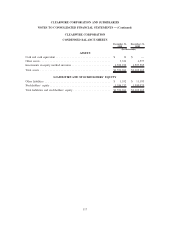

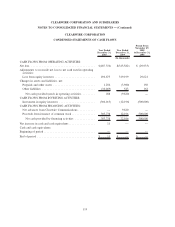

19. Parent Company Only Condensed Financial Statements

Under the terms of agreements governing the indebtedness of Clearwire Communications, a subsidiary of

Clearwire, such subsidiary is significantly restricted from making dividend payments, loans or advances to

Clearwire. The restrictions have resulted in the restricted net assets (as defined in Securities and Exchange

Commission Rule 4-08(e)(3) of Regulation S-X) of Clearwire’s subsidiary exceeding 25% of the consolidated net

assets of Clearwire and its subsidiaries.

The following condensed parent-only financial statements of Clearwire account for the investment in

Clearwire Communications under the equity method of accounting. The financial statements should be read in

conjunction with the consolidated financial statements of Clearwire and subsidiaries and notes thereto. As

described in Note 1, Description of Business, Clearwire was formed on November 28, 2008 and therefore, the

condensed statement of operation and the condensed statement of cash flow for 2008 only included activity from

November 29, 2008 to December 31, 2008.

116

CLEARWIRE CORPORATION AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — (Continued)