Clearwire 2010 Annual Report Download - page 89

Download and view the complete annual report

Please find page 89 of the 2010 Clearwire annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

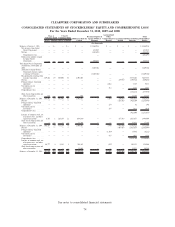

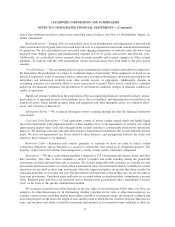

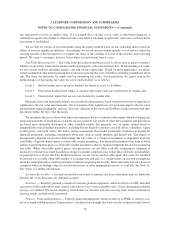

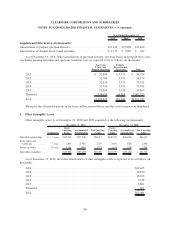

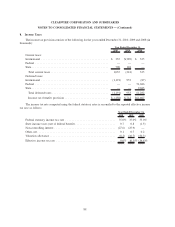

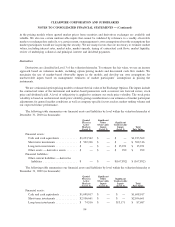

4. Property, Plant and Equipment

Property, plant and equipment as of December 31, 2010 and 2009 consisted of the following (in thousands):

Useful

Lives (Years) 2010 2009

December 31,

Network and base station equipment ............ 5-15 $3,160,790 $ 901,814

Customer premise equipment.................. 2 147,959 60,108

Furniture, fixtures and equipment .............. 3-7 433,858 216,598

Lesser of useful

Leasehold improvements ..................... life or lease term 49,712 18,128

Construction in progress ..................... N/A 1,299,244 1,623,703

5,091,563 2,820,351

Less: accumulated depreciation and amortization . . . (627,029) (223,831)

$4,464,534 $2,596,520

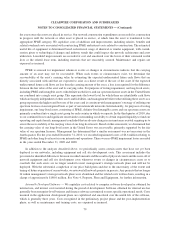

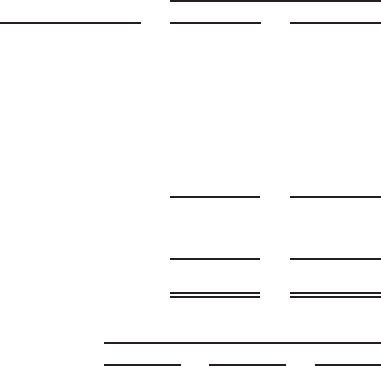

2010 2009 2008

Year Ended December 31,

Supplemental information (in thousands):

Capitalized interest .................................. $208,595 $140,168 $ 4,469

Depreciation expense ................................. $435,236 $170,131 $54,811

We have entered into lease arrangements related to our network construction and equipment that meet the

criteria for capital leases. At December 31, 2010, we have recorded capital lease assets with an original cost of

$73.0 million within network and base station equipment.

Construction in progress is primarily composed of costs incurred during the process of completing network

projects. The balance at December 31, 2010 also includes $289.8 million of network and base station equipment not

yet assigned to a project, $56.6 million of CPE that we intend to lease and $97.9 million of costs related to

information technology, which we refer to as IT, and other corporate projects.

We periodically assess certain assets that have not yet been deployed in our networks, including equipment and

cell site development costs. This assessment includes the provision for identified differences between recorded

amounts and the results of physical counts and the write-off of network equipment and cell site development costs

whenever events or changes in circumstances cause us to conclude that such assets are no longer needed to meet

management’s strategic network plans and will not be deployed. With the substantial completion of our prior build

plans and due to the uncertainty of the extent and timing of future expansion of our networks, we reviewed all

network projects in process. Any projects that no longer fit within management’s strategic network plans were

abandoned and the related costs written down.

84

CLEARWIRE CORPORATION AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — (Continued)